Countries worldwide continue to grapple with an energy crisis exacerbated by the Russian invasion of Ukraine and overall supply-chain issues caused by the Covid-19 pandemic.

But for traders that just discovered energy stocks as the new hip “momentum trade,” it was a rough week. 🤢

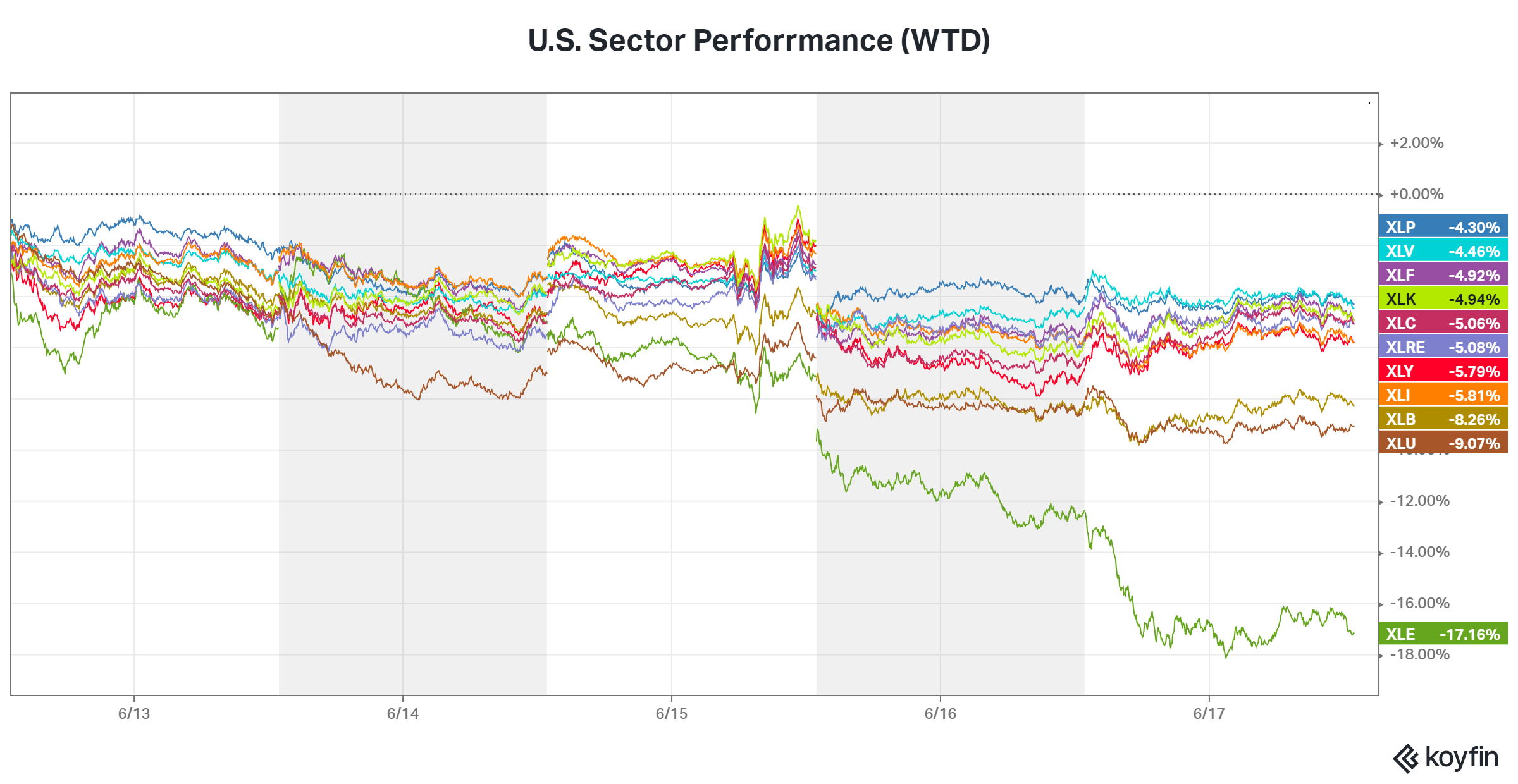

While it was a general down week for the stock market, the large-cap energy ETF was down 17%! Other ETFs with small/mid-cap names fared even worse! 🔻

Oil, Gasoline, Heating Oil, and Natural Gas futures all sold off to varying degrees. 🛢️

After many unsuccessful attempts to bring prices down by increasing investment in alternative energy sources, getting OPEC+ to increase production, and tapping the strategic petroleum reserve, what is finally causing prices to move?

Many traders are pointing to the pickup in global recession fears following the aggressive rate hikes by the Federal Reserve and other central banks. 📈

A global recession is not how we wanted to bring down oil prices, but collapsing demand would undoubtedly do the trick.

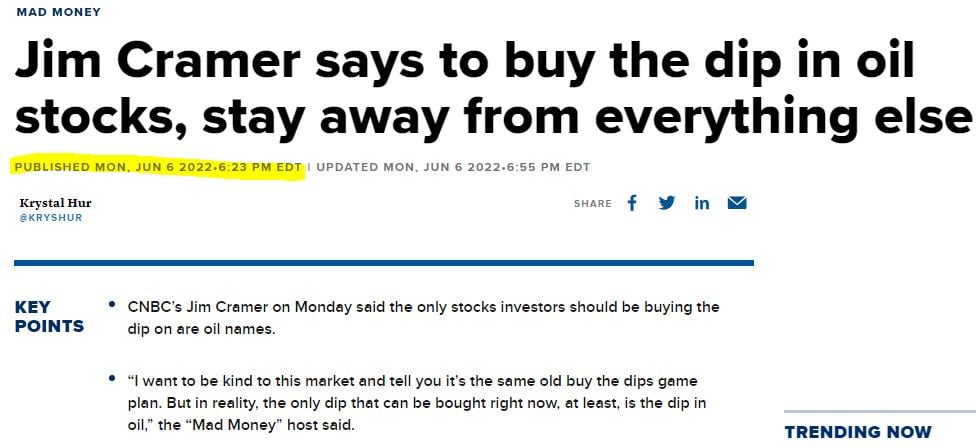

Others are pointing to the infamous “Cramer curse” for the recent weakness. Ok, kidding…kidding (kind of). 🤣

What’s clear is that this week’s volatility is a change of character worth acknowledging. ⚠️

Energy markets are likely to continue delivering fireworks for the foreseeable future, given the broader structural/geopolitical issues and the uncertainty facing many economies.

Let us know what you think about this week’s action. Is this a blip on the radar of a long-term uptrend or a trend reversal sign? 🤔

Join the streams and tag us @Stocktwits. 💭