In August, we discussed how Crude Oil prices are looked at by many as a real-time measure of inflation. The idea is that the cost of crude oil and other energy commodities takes time to be reflected in the producer and consumer price indexes.

So while we wait, we can use futures prices to provide some directional indication of what to expect. And since August, there’s been a lot of volatility in crude oil prices but not much directional progress.

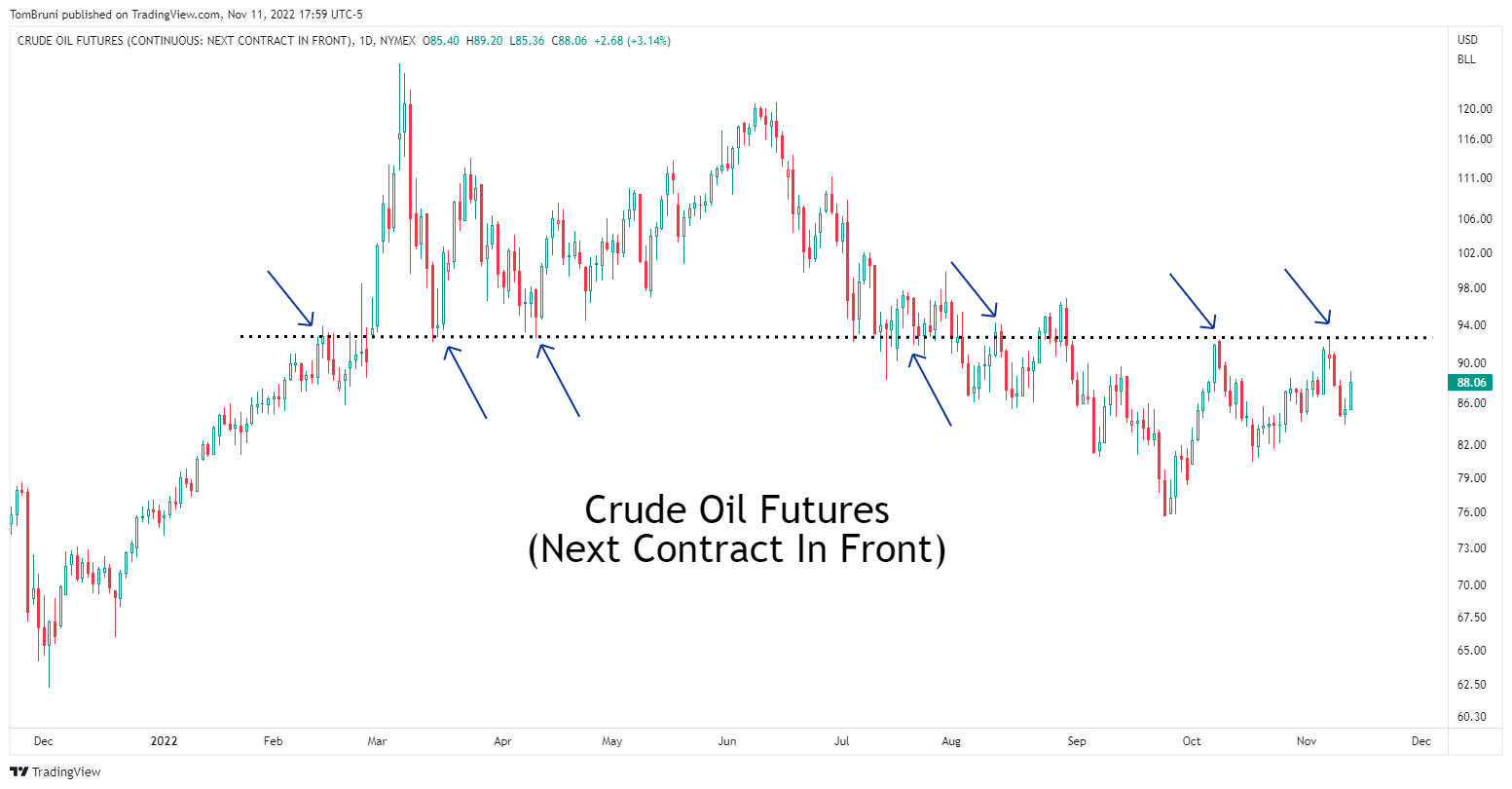

As we await a resolution, analysts are watching the low 90s, where supply and demand have consistently shifted over the last year. They argue that prices have a downward directional bias if below that level. And have an upward directional bias above that level.

Given this week’s inflation reading was cooler than expected, “peak inflation-ers” want to see crude oil prices stay below that level.

We’ll just have to wait and see what happens. 🤷