As planned, AMC Entertainment’s new preferred share class called “APE” units began trading today.

They were supposed to be distributed to investors’ accounts on Friday after the bell. Still, many had to wait until this morning…sparking a lot of weekend debate and conspiracy theories about what could be happening.

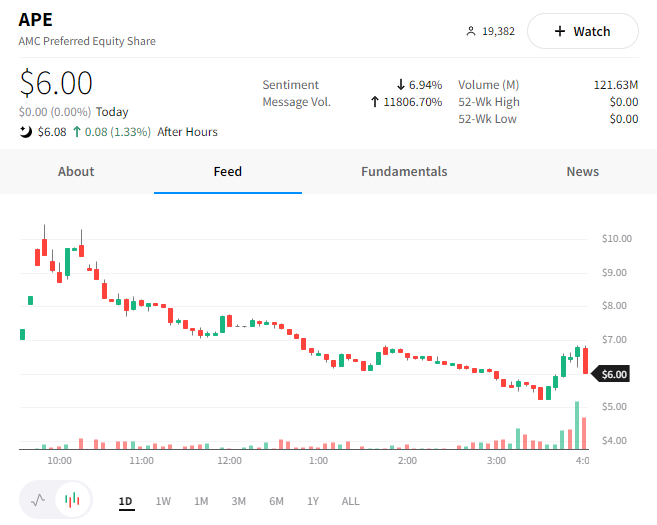

Despite the concerns, the shares began trading as expected but spent the day trading lower after a strong initial pop. 📉

Whether or not this financial engineering move will help the company raise enough cash to turn its business around remains to be seen. Given the stock’s recent downturn, that window may be closing faster than the company had hoped.

AMC investors saw their common equity shares plummet over 40% today, back to their lowest levels since June. 🔻

What contributed to the drop was likely a mix of the special dividend, weak market environment, and news that its competitor, Cineworld, is considering filing for bankruptcy. 😬

If you want to keep an eye on $APE shares over the coming days and weeks, join the 20,000 other investors and traders on that stream. 👀