It’s September, so it’s time for Apple’s annual iPhone event. 📱

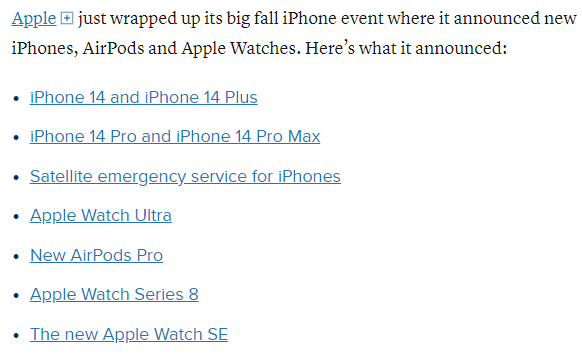

CNBC has a good summary of the new iPhones, AirPods, and Apple Watches announced:

The first thing of note is that the prices of the new iPhone stay the same as last year. Given the inflationary pressures facing most of the U.S. economy (and the world), many had expected a price increase for most of Apple’s products.

Additionally, Apple’s push into health care continues. Its new Apple Watch Series 8 has a temperature sensor, which can help monitor health data, including ovulation. Given the sensitivity of this health data, the company designed the device to keep data secure with enhanced security features. ⌚

And speaking of safety, the company also announced the ability to connect its iPhone 14 series to satellites for emergency services. Apple partnered with Globalstar to offer this long-rumored capability. 🆘

The stock didn’t react much today, which CNBC notes is fairly typical based on past events. Instead, we should expect movement in a month or two as data about the current iPhone cycle trickles in. 🗓️