Credit Suisse has had its fair share of problems over the years, and that’s putting it lightly. 🙄

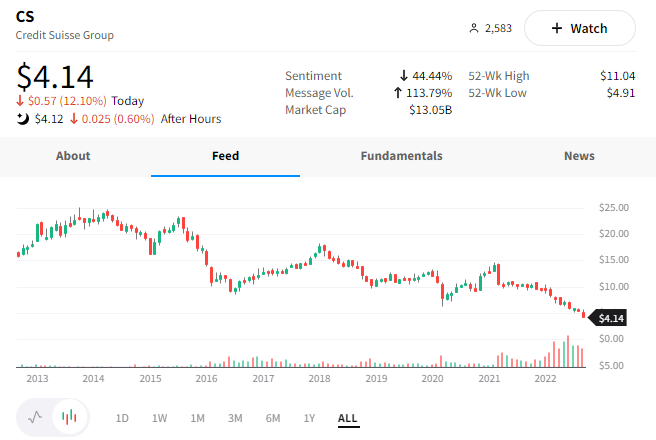

This week, shares of the Swiss Bank fell more than 20% on news that the company is searching for fresh capital for the fourth time in seven years.

It started speaking with investors about the move in recent weeks, considering a variety of options. One of the more drastic options includes exiting the U.S. market entirely. This would mean selling its U.S. investment banking and asset management businesses. Though, the company has said it will not exit the U.S. market.

As the global economy weakens and rates rise, what’s clear is that struggling companies like Credit Suisse will have a harder time executing their turnaround strategy. They no longer have cheap financing and rising equity markets as a backdrop. Instead, they face the most challenging business and financing environment in over a decade.

The company’s next steps remain to be seen. But so far, investors don’t appear to have a lot of optimism as shares fell 12% today to a new all-time low. 😬