Toothpaste and software companies don’t typically have much in common, but today they do. Colgate and Salesforce have both attracted the attention of activist investors. 🧐

Starboard Value is picking up shares of Salesforce after they’ve fallen more than 50% over the last year. The fund’s founder, Jeff Smith, says there’s opportunity in the enterprise software maker and that its valuation discount is due to a “subpar mix of growth and profitability.”

It did not reveal the size of its investment. However, it stated that its stake is “significant.” 💰

The fundamental-focused activist hedge fund also revealed a roughly 5% stake in another software company, Splunk, yesterday. And last month, it announced a 9% position in the website development platform Wix.com.

$CRM shares were up as much as 8% this morning, coming off their lowest level since April 2020.

Now that Dan Loeb’s Third Point is taking a break from its fight with Disney, the firm’s taking aim at another multinational giant, Colgate. 🪥

Loeb believes Colgate could unlock additional value in its pet food subsidiary, Hill’s Pet Nutrition, by spinning it off into a standalone business. A spinoff occurs when the parent company distributes new shares of an existing business to create an independent company. The idea is that the spun-off company is worth more on a standalone basis than as part of a larger business.

Loeb estimates the pet food company could command a $20 billion valuation based on its 2023 numbers. Additionally, he says that consolidation in the consumer health sector creates more opportunities for Colgate to become even more prominent in the space. 🐕

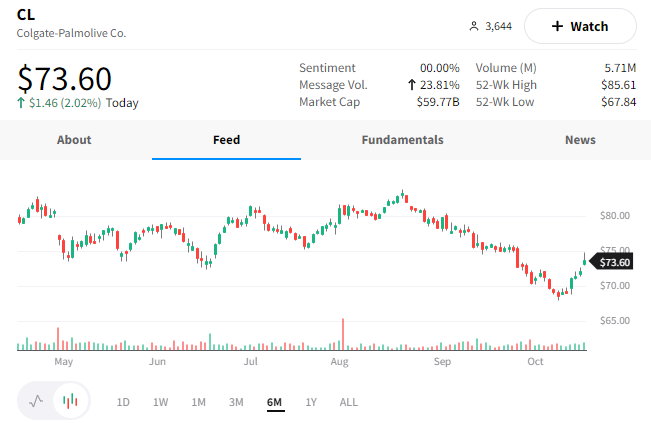

$CL shares were up nearly 4% on the news but have backed off as the market retreats.

In today’s challenging market environment, history suggests we can expect to hear from more activist investors looking to “force” value into the securities they own.

Executives, consider this your formal notice. 📝