The world’s largest company was in the news for a couple of reasons today. Let’s recap. 📝

First was a report that the company could see a production shortfall of almost 6 million iPhone Pro models due to the unrest in China. The covid lockdowns and pro-democracy/pro-worker protests continue to affect production at Foxconn’s plant, where workers have left in droves. 🏭

Additionally, Elon Musk claimed that Apple threatened to remove the Twitter app from the App Store. He claims it is part of Apple’s “app review moderation process” and that they won’t provide a reason why Twitter’s app could be removed.

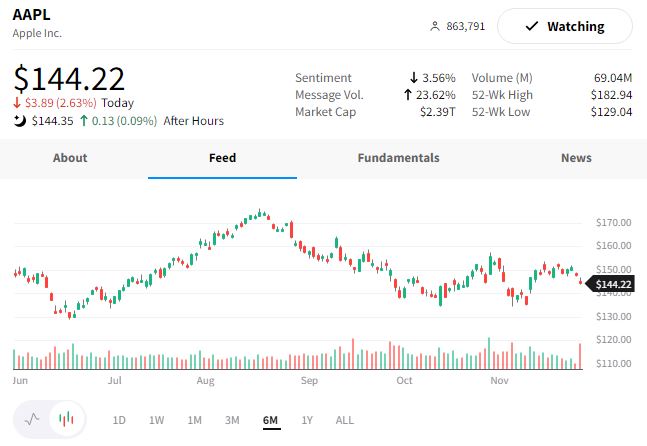

Lastly, traders are watching $AAPL shares make a lower high, which many traders view as a sign of further downside to come. The bellwether stock has held up better than its peers but would weigh on the market heavily if it began to move lower.

We’ll have to see if today’s weakness continues or if it was a one-off. Either way, traders will definitely be watching this chart into year-end. 👀