In a post-Jack Ma era of slower growth, Chinese e-commerce giant Alibaba is turning to financial engineering to drive value. 📝

Today the company outlined the most significant reorganization in its history, designed to unlock shareholder value and foster market competitiveness. The business will be split into six separate companies, each led by its own CEO and board of directors. 🧑💼

They each revolve around strategic priorities, including:

- Cloud Intelligence Group – Cloud and artificial intelligence (AI) activities.

- Taobao Tmall Commerce Group – Online shopping platforms, including Taobao and Tmall.

- Local Services Group – Food delivery service Ele.me and mapping.

- Cainiao Smart Logistics – Alibaba’s logistics service.

- Global Digital Commerce Group – International e-commerce businesses, including AliExpress and Lazada.

- Digital Media and Entertainment Group – Streaming and movie business.

Each unit will be able to pursue independent fundraising and public listings if/when ready. However, Taobao Tmall Commerce Group will remain a wholly-owned subsidiary of Alibaba. 🛒

With growth slowing across the business, the move should give each unit the flexibility to win in its competitive markets. It should also reduce the regulatory headwinds Alibaba dealt with as a massive conglomerate.

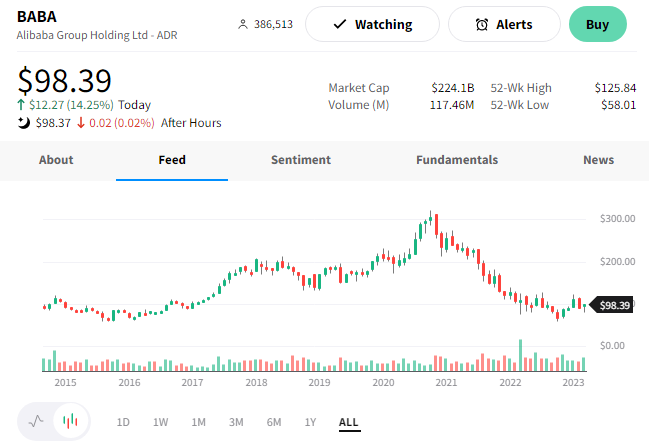

$BABA shares rallied 15% on the news. However, they’re still trading at their late-2014 IPO levels. 🔻