Well, it was a busy day in the media industry, with several popular news anchors getting the axe. Let’s see what happened and how it moved markets. 👀

First up, Fox News announced that it is parting ways with Tucker Carlson and that his last program aired on Friday. This came as a shock because “Tucker Carlson Tonight” has been one of the network’s top-rated programs.

The brief company statement said that “FOX News Media and Tucker Carlson have agreed to part ways. … We thank him for his service to the network as a host and, prior to that, as a contributor.”

The news comes just days after the company reached a settlement with Dominion Voting Systems in its defamation lawsuit. While Fox did not comment on whether Carlson’s removal is in response to the lawsuit’s results, most are speculating that was the trigger. 🤷

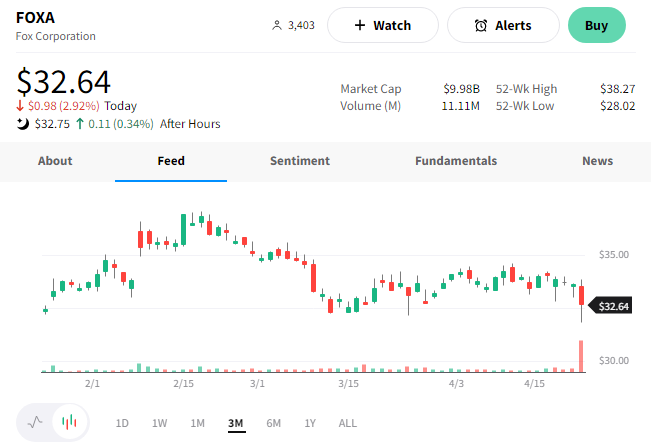

$FOXA shares fell about 3% on the news. 👎

Meanwhile, CNN fired anchor Don Lemon because of his sexist comments and reported mistreatment of women during his tenure. ❌

The host of “CNN This Morning” claims his agent informed him about the news on Monday morning. In his tweet, he says he wished management had spoken with him directly rather than through his agent. However, CNN fired back via Twitter, saying he had the opportunity to meet with management but instead chose to take to social media.

Overall, Lemon said he had no indication that this action was coming and that“…it is clear that there are some larger issues at play.”

Shares of Warner Bros. Discovery, which owns CNN, were down about 2% on the day. 📉

Lastly, NBCUniversal CEO Jeff Shell is being ousted after admitting to an “inappropriate relationship” with a woman in the company. This comes roughly a month after outside counsel was hired to investigate a sexual harassment and sex discrimination complaint filed by a CNBC news anchor and international correspondent. 📝

For now, Mike Cavanagh, Comcast’s president, will run the NBCUniversal division until a replacement is identified. The company’s next leader will have to deal with a number of major decisions, and soon. These include Hulu’s buyout, NBA broadcast rights, and merging with Warner Bros. Discovery.

NBCUniversal’s parent company, Comcast, saw its shares fall over 1% on the news. 🔻