Before we dive into the good news in the crypto space (and there is), it’s important to remember that the only thing bearish about cryptocurrencies is the price action. Adoption, attention, use, and interest have only grown and continue to grow.

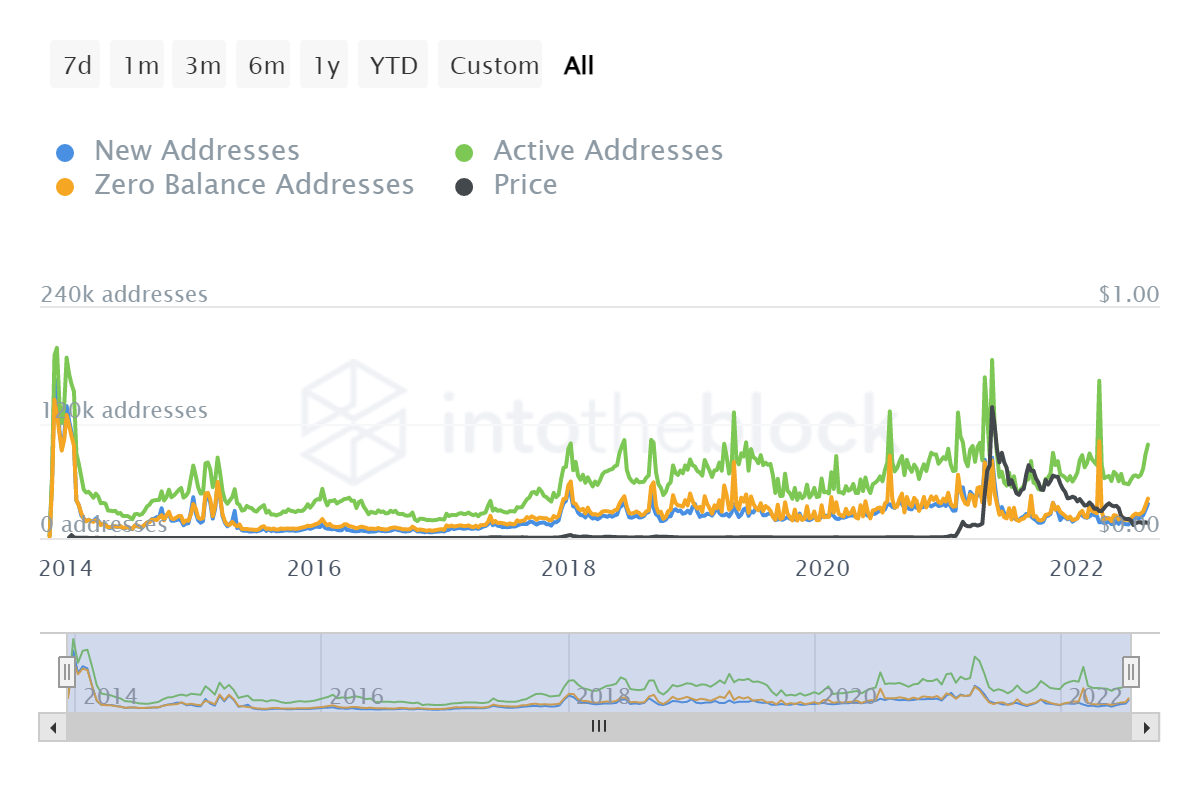

The image above is from the on-chain analytics service, IntoTheBlock. The active Dogecoin ($DOGE.X) addresses have exploded by nearly 265%. Why is this a big deal? Because Dogecoin represents a part of the cryptocurrency market that is the most speculative: memecoins.

If there is renewed interest and new participation in cryptocurrencies like Dogecoin, some analysts view that growth as a warning sign of a new ‘altcoin season’ developing. But Dogecoin isn’t the only memecoin finding buyers.

According to WhaleStats, Ethereum ($ETH.X) whales have increased Shiba Inu ($SHIB.X) holdings from $736,000 to a whopping $5 million – nearly +580% higher over 24 hours.

On the regulatory side, The Law Commission of England and Wales recommended that a new category of property is needed to provide legal protection for digital assets. The new category’s label is data objects. Existing private property laws would then extend to cryptocurrencies. 😁