The Litepaper got a chance to visit with Input Output Group’s (IOG) Chief Marketing Officer, Jerry Fragiskatos. Who is IOG? Well, they’re the team that develops Cardano ($ADA.X) until Cardano is ready to walk on its own – which isn’t very far away!

With Ethereum’s Merge ($ETH.X) already behind us and Cardano’s Vasil hard fork complete just yesterday, there’s a lot of questions I had.

Before diving into some specifics, can you explain what the heck Layers are?

Sure, it’s good to start at the beginning to understand how this all fits together.

Layer 0 is the internet itself. Layer 1 is the blockchain, the distributed ledger that requires a consensus mechanism and creates value and/or allows for value to be transferred over the internet.

Coming to Layer 1, the grand-daddy of them all is Bitcoin (BTC.X). But it doesn’t have smart contracts. It’s really just a store of value chain, just Bitcoin, that’s the product, that’s what it is. It’s all about monetary policy and really just that: a store of value case.

It’s also technologically based on something called UTXO, unspent or unused transactions. It’s the model used to account for the tokens in the blockchain – like how cash works. UTXO is one model, then there’s an accounts-based model similar to how credit cards work, and that’s what Ethereum and others use.

Then there’s the concept of multi-asset and smart contracts, which is where Cardano starts to differ.

Let’s dive in: Explain Cardano’s history to the Litepaper readers; why was it developed?

So, going back to where it all started, Bitcoin was started by Satoshi Nakamoto and became decentralized out of the gate and has become the juggernaut it is.

Ethereum tried to put programmability on top of it using an account-based model but was using the method of: “move quickly and break things” method.

Charles Hoskinson, our founder, was one of the co-founders of Ethereum; he didn’t like, philosophically, how the industry approached this development. He said, “Hey, this is where value will be transferred by billions of people worldwide.” We need to be careful.

We’re not as concerned about financial inclusion in the developed world – it serves us relatively well. Well… good enough where we’re not looking for alternatives.

In the emerging world, it’s not profitable for banks to service those people, which is why Cardano and IOG have such a big focus on Africa and emerging markets, so they’re not serviced.

There are 1.7 to 2 billion people unbanked and another 3 billion underbanked. So, returning to the first principles, how do we create a system to serve those people?

First, it needs to be secure and decentralized. That’s where you start. What we’ve done with Cardano is go back to first principles and start from scratch. This is where we differ from most blockchains.

But it’s really about starting with peer-reviewed scientific papers and going through a rigorous scientific process to rebuild a blockchain from scratch. So it’s really building from the ground up.

The first big innovation from that process was our consensus mechanism, Ouroboros. And this is also a big divergence from the industry where we went to Proof of Stake. Ouroboros is a scientific breakthrough in our industry. It’s self-sustaining.

Besides the massive drop in energy required, what makes Proof-of-Stake desirable? How does Proof-of-Stake prevent a 51% attack that can occur on a Proof-of-Work network?

That’s where complicated cryptography and game theory come into play. And that’s how you incentivize the network to be secure, and that’s through complex game-theory and formulas that determine how big a stake can be, so you can encourage decentralization, but also that it’s significant enough it would require an enormous amount of resources to overtake the network – and that’s what Ouroboros does.

Stakers get rewarded for securing the network, allowing a vibrant community of stake pool operators to form – creating the base layer.

The ecosystem that builds on top of Cardano through our smart contracts rests on that solid foundation. That’s the key. And we must be very careful about balancing security and decentralization. That was the first part of our road map – to ensure no outside actor could disrupt it.

I think that people don’t understand where we are in the life cycle of the industry. People are like, ‘Where’s the next web3 application on my iPhone?’, that’s the time cycle they’re on. But the industry isn’t there, the industry is more like in the 1990s of the internet.

What do you say to Cardano investors and critics who say the development process is slow compared to its peers and other projects?

We feel that our philosophy is best served by a system that’s going to have nation states on it, a value transfer with billions of people on it. That’s the idea. So we’re not going to move fast because that’s our end goal.

My entire time as Chief Commercial Officer is working with big enterprises and governments and explaining this to them to help them understand.

What is something about Cardano that makes it unique or may surprise investors?

There are a lot of technological advantages of Cardano that don’t really get a ton of media attention. One of them is our native assets standard.

The way that assets work on Ethereum, for example, requires a smart contract to create an asset out of the gate. On Cardano, you can mint an asset, which will be treated as ADA. This is why Cardano has become such a great platform for NFTs, it’s much more efficient.

Our fee structure is also very competitive, our fees are nowhere near what they are for Ethereum.

In how our system functions, there are inflation and transaction fees – 80% go to the consensus mechanism, and the other 20% go to a treasury system, which is tapped by Catalyst. It’s a self-sustaining treasury system.

And that (Catalyst) is another big part that doesn’t get the big media attention it should is the Catalyst program. Catalyst is a protocol built on top of Cardano that allows the community to vote on projects and improvements on the platform.

The ultimate goal is to give the protocol back to the community 100%, and then they run, and then we (IOG) become community members like everyone else. That happens when governance is complete.

How does Cardano address scalability issues?

Let’s talk about the road map and eras that led to where we are now.

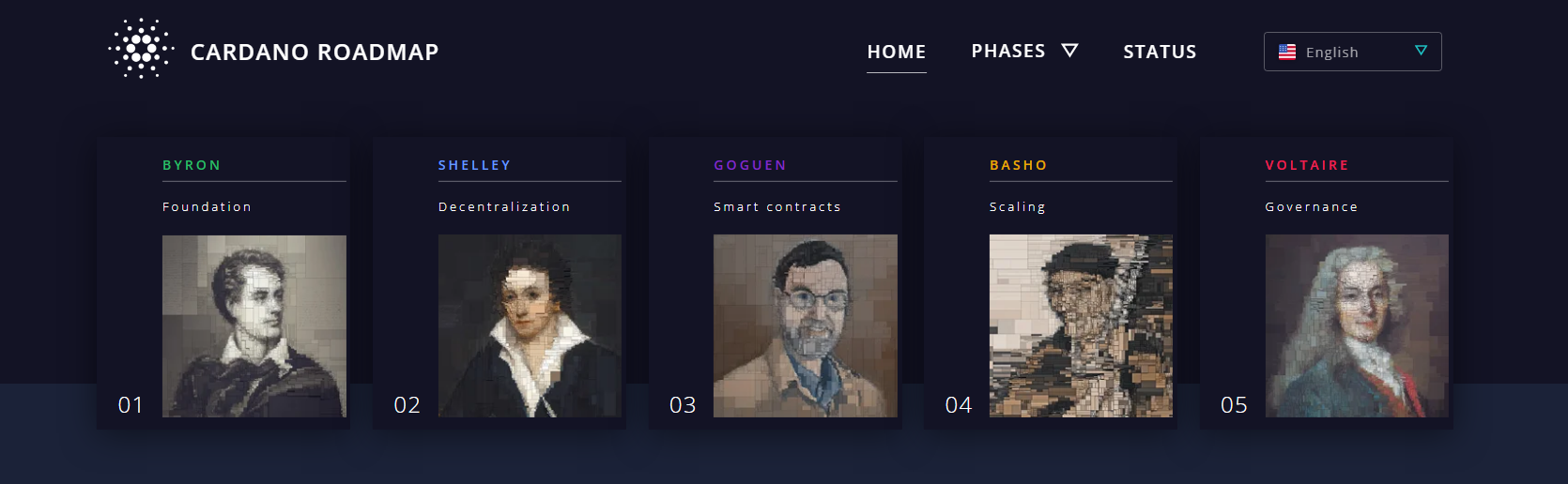

Byron was the original era, where the base layer was formed. Shelley was the Proof-of-Stake mechanism. Mary was the native asset standard. Gogun was the smart contracts. At that stage, we had a secure and decentralized network. Basho is about scalability, improving throughput and scalability without sacrificing decentralization and security.

And this is where all the noise comes from, all this talk about, ‘oh, you’ve had smart contracts for a year; why aren’t you as big as other players?’ It’s because it’s a step of the process. The next hard fork, Vasil, vastly increases the system’s scalability. A lot of the projects out there are waiting for that upgrade.

The last phase is Voltaire – which is the self-sustaining governance system. That’s when the community truly fully takes control. Right now, we don’t control it, consensus is already made by the community.

The last phase is the self-sustaining system funded by the treasury that’s generated by the system. Then we have something unique in our industry: self-sustaining, secure, scalable decentralization. Once you have that, the momentum will be impossible to take over, the growth will be massive.

And people won’t see it coming because people are tuned into what’s the next month or the next quarter – they’re not tuned into the long-term phased approach.

See the Cardano road map here.

Voltaire – when is that complete?

Well, we’re in the Voltaire era for Catalyst. All I can say is that 2023 will be a big year for Voltaire.

What safeguards does Cardano have to prevent a central authority from locking a person out of Cardano?

Technologically, it’s impossible. It’s a decentralized system that runs by itself.

Legally and from a regulation standpoint, sure.

How do governments/people respond to this technology? Is there a difference between developed and developing countries in their response?

First, it’s important to understand there are two options.

Option A – TradFi (Traditional Finance) doesn’t want to bank in a developing nation because it’s not profitable, or they charge insanely high interest, and then you sometimes have people that are corrupt in that system that you rely on to enforce, often on top of a currency that is not stable.

Option B – a proven secured network. It’s on the blockchain, so it’s transparent, and it has access to global liquidity.

I talk with governments and enterprises all the time, last year I visited six African nations. It’s very different talking to developed nations. They’re more worried about hacks and scams – which do exist in our industry. But all the conversations are about integrating Cardano into their regulatory, traditional finance, and corporate systems.

But people in developing countries? They’ve already decided they’re going to leapfrog the traditional systems. They’re leapfrogging the developed world. It’s grassroots, the people want this. It’s an exciting generational shift.

Is the native Daedalus wallet like a bank vault and the upcoming Lace wallet like a debit card?

Daedalus is the secure wallet – and Lace is our other wallet which we previewed at Consensys. Lace is our lite wallet version of that. If you have big sums and need them to be really secure, use the base layer, use Daedalus. If you want more speed and more efficiency, that’s where Lace comes in – it’s all about the use case.

How does Cardano compare with Ethereum after the Merge? Is Cardano faster and more scalable?

It is. They’re (Ethereum) doing what we’ve already done. I wish them well; it’s a massive ecosystem that they’re changing everything, whereas ours is already built that way. We were already Proof-of-Stake.

But listen, I hate the zero-sum game beliefs that people have in this industry. There’s no reason why multiple can’t exist and serve people. Interoperability is going to be the next big thing where you won’t even realize you’re using blockchain X versus blockchain Y in the future.