It was a slower day on the news front, so let’s use this time to catch up on recent crypto-related stock market news from the last few days. 📰

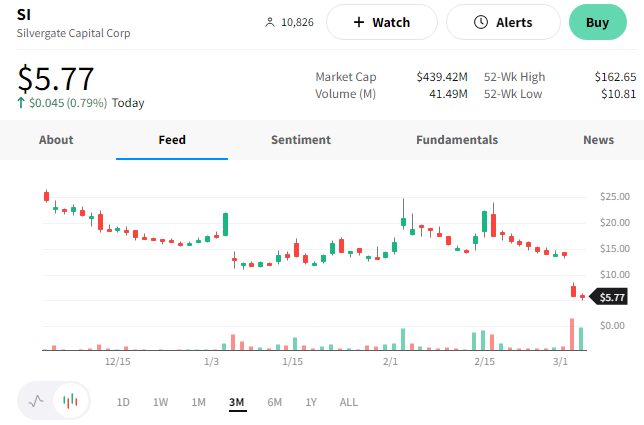

First up is Silvergate Capital Corporation’s massive decline after the company delayed its annual report filing. Executives need additional time to evaluate the “subsequent events” that have happened since the end of 2022 and may need to be included in their report. 🕵️

Specifically, its filing cited it needed to look into “the sale of additional investment securities beyond what was previously anticipated” and the “impact that these subsequent events have on its ability to continue as a going concern.”

These are not the type of words investors like to hear from a company, let alone a bank. The news left a “grand canyon” sized gap in the chart of $SI as prices fell nearly 60%. 😮

Coinbase has distanced itself from Silvergate as well. The company publicly reiterated that its client cash is held at FDIC-insured U.S. banks, and it has “de minimis” corporate exposure to Silvergate.

On another note, Coinbase also acquired One River Digital Asset Management (ORDAM), which provides institutional clients exposure to digital assets through investment products. The deal’s financial details were not disclosed, but ORDAM will become Coinbase Asset Management and operate as a fully-owned unit. This is another example of the biggest players using the recent drop in valuations to expand their offerings. 🤝

Apple is reportedly continuing its less-than-friendly history with the crypto industry. The largest DEX and DeFi asset, UniSwap, is alleging that it’s not received app-store approval despite submitting the app months ago. Even though its application is 100% compliant with the required specifications, Uniswap says it’s still stuck in “limbo.” 🍎

FTX executives say the company has finally inventoried all the wallets associated with FTX.com. Their analysis has identified a roughly $9 billion shortfall between what’s owed and what liquid assets remain. It also noted that Alameda borrowed a net of $9.3 billion from FTX.com, which could account for much (or all) of the gap between its remaining assets and customer liabilities. 💰

More banks, including HSBC and Nationwide, are limiting their customers’ crypto purchases as regulatory scrutiny heats up. Meanwhile, other financial services providers like Visa and Goldman Sachs are pulling back their public crypto efforts but still working on them behind the scenes until the market environment improves. ₿