Feel out of the loop with what the heck is going on with the bank fears and doom and gloom over the past couple of weeks? I’ll try and make it as simple, fast, and painless as possible. 🤕

This means a nice big chunk of the nitty gritty details won’t be in here, but you can read them in the fantastic article from last Friday’s Daily Rip.

Also, I loved picture books as a kid (probably why I like charts) and thought a picture book-ish version would make it easier.

Let’s start with this guy:

When his dumpster fire FTX collapsed, fallout led to people doing this:

which affected this crypto bank:

that made ‘big money’ in the tech and fintech world go:

and do virtual versions of this:

that spooked more investors and then spread to this hugenormously important bank:

The shite storm with Silicon Valley Bank came to a head late last week, with experts fearing this would happen in the financial system:

Then, over the weekend, a familiar entity arrives to save the day:

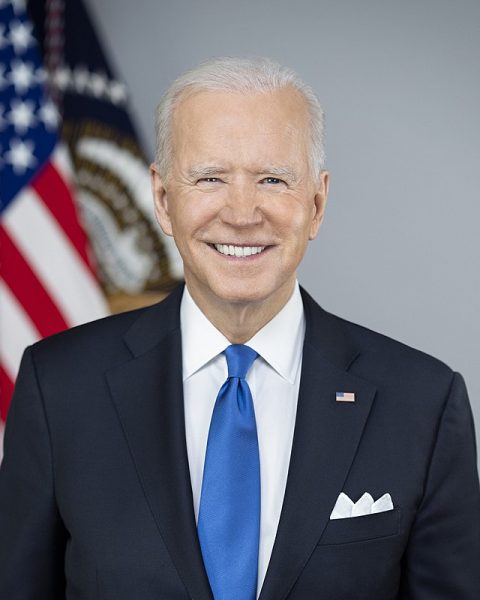

And finally, to put everyone’s concerns to rest, an elected official who typically reserves surprise television broadcasts for new wars, terror attacks, or impending zombie apocalypses made a surprise television broadcast to reassure us that everything is okay:

And that’s where we are today.