Market makers, often perceived as wealthy elites, play a vital role in the stock market, constantly buying and selling, ensuring liquidity. 💦

This lucrative area is typically inaccessible to the average person, but DeFi opens up similar opportunities for everyday investors. However, diving into DeFi as a liquidity provider isn’t a fast track to huge gains; it’s more about consistent income generation. And lots of heartburn.

But ‘income generation’ in DeFi is a cloudy word. You will deal with non-fiat crypto pools unless you participate in a stablecoin pool. For the real-life example we’re going to look at, for me, the focus is accumulating more ADA; I’m not worried about the short-term value of ADA in USD.

Your Spouse Might Kill You If She Finds Out

Becoming a liquidity provider in the DeFi/DEX space is not for everyone. If you’re an investor or trader in crypto, congratulations, you’re already in arguably the riskiest asset class around, like swimming with great white sharks for fun. 🦈

Diving into liquidity pools is even more insanely risky – you’re still swimming with great white sharks for fun, but in this scenario, your wet suit has hundreds of tiny reflective mirrors, and instead of flippers, you’re wearing chum buckets on your feet.

Again, for me, becoming a liquidity provider in the ADA/INDY pool makes sense because:

- I’m focused on accumulating more ADA, not the $$$ amount.

- I know the risk and am ready to accept a loss due to market fluctuations and other crypto shenanigans.

- My wife doesn’t know how much I risk, so there’s no immediate threat of divorce.

Get Your Arm Floaties Cause This Pool Is Dangerous Bru

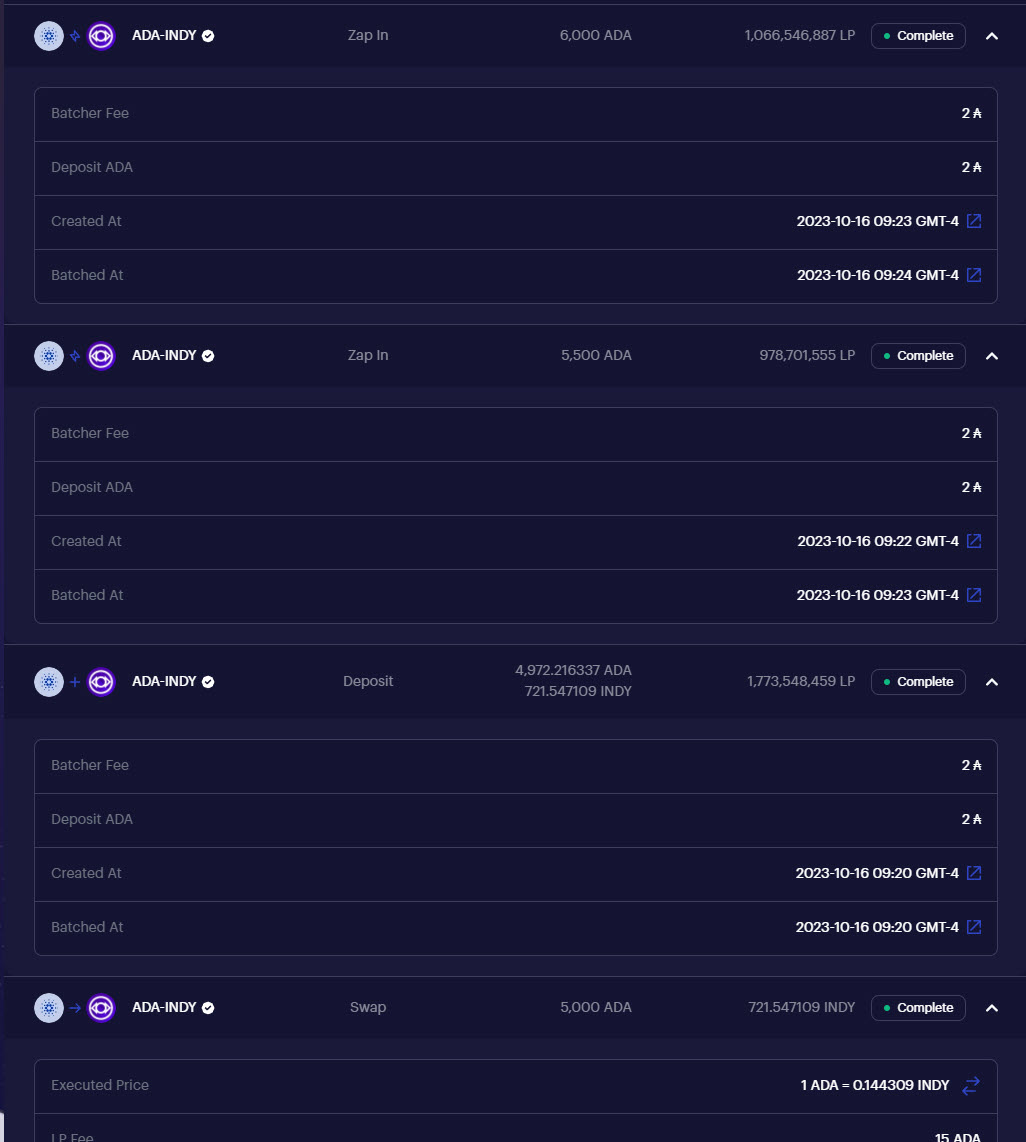

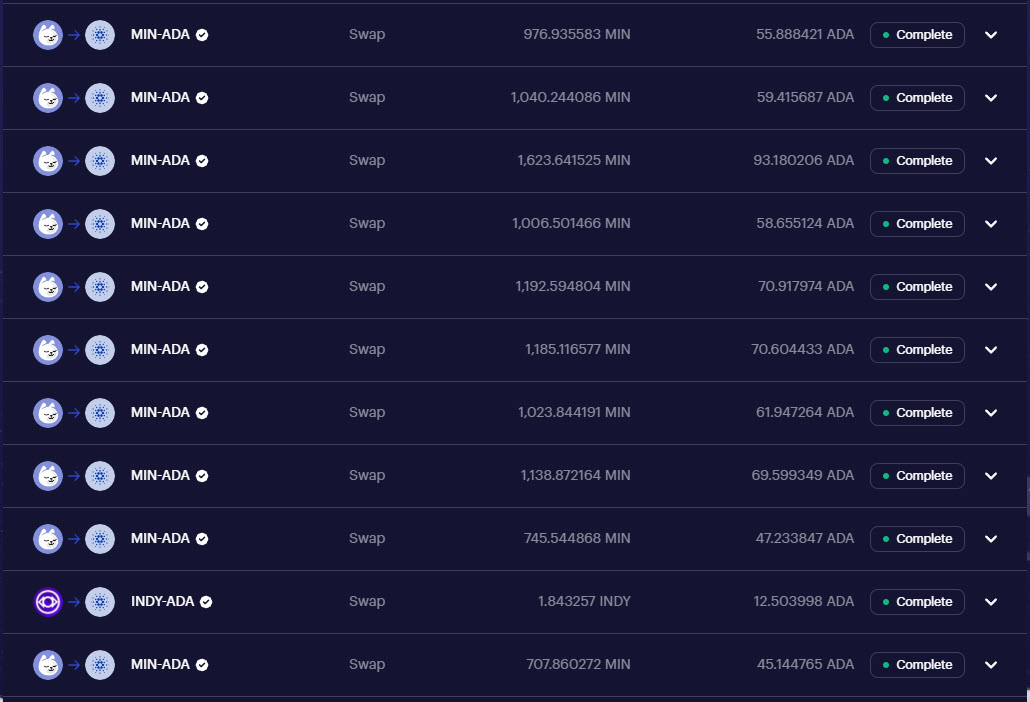

My recent venture into the ADA/INDY liquidity pool (LP) is a case in point. Joining the LP required an even split of ADA and INDY. The rewards for providing liquidity include MIN (Minswap’s native token), ADA, and INDY, plus a portion of trading fees.

After two months in the ADA/INDY LP, I realized a gain of +965.15 ADA. How does that compare to staking the same amount? It far outstripped the 123.58 to 182.75 ADA per month from standard ADA staking – a 164% increase over the best-case staking scenario. 👍

BUT

There’s always a but – I have an ugly unrealized loss going on at the same time due to <cue dramatic hamster sound bit> Impermanent Loss.

Impermanent loss is when the value of your deposited crypto in a DeFi liquidity pool decreases compared to just holding them on your own due to price changes.

In the past two months, INDY dropped -35% against ADA, reducing the original ADA value of the INDY from 31k ADA to 20.2k ADA (although, at the time of writing this, INDY is now up +15% from those lows). 😢

Worth It?

I have no idea yet.

So, while the short-term depreciation in INDY is full of the suck, I’m still in it. Will it play out in my favor? Who knows. I’ll keep you updated as time moves on. ⏰

And Check Out Our Crypto 101 Content On Defi

Crypto 101: Understanding the Risks of Decentralized Exchanges (DEXs)

Crypto 101: Unpacking Automated Market Makers

Crypto 101: Plunging Into Liquidity Pools

Crypto 101: Journeying Into the World of Decentralized Exchanges (DEXs)