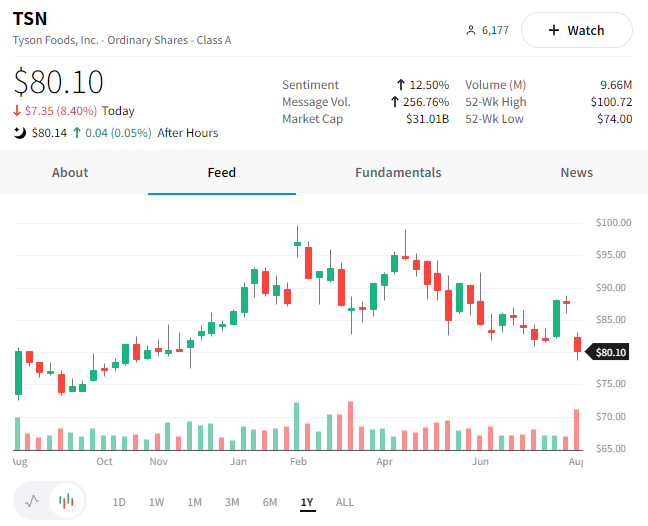

First, let’s start with Tyson Foods, which did not bring home the bacon for investors. Instead, the multinational food company reported weaker than expected earnings and revenues.

The company warned that supply constraints and reduced demand for high-priced beef would continue to pressure its earnings.

$TSN shares were down 8.40% as it joins many other companies citing a tougher macro environment and inflation as major headwinds. 🔻

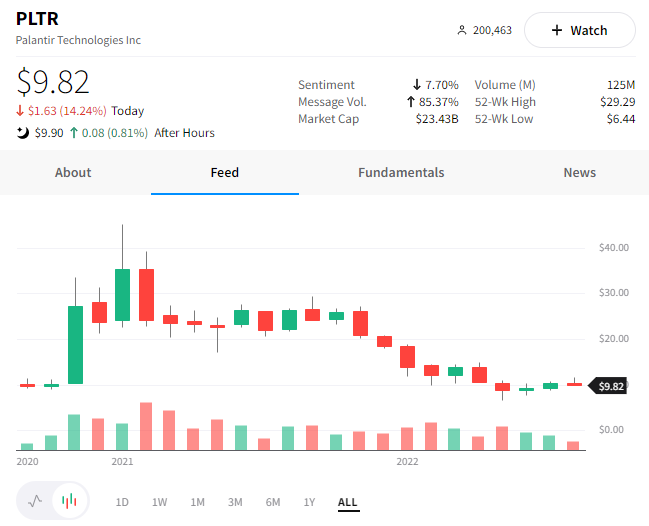

Shares of popular tech stock Palantir plummeted 14.24% after reporting weaker than expected earnings but slightly beating on revenue.

The company’s CFO said that the earnings miss was primarily due to a decline in investments and marketable securities and that its commercial revenue remains strong, growing 46% YoY. 💪

Overall, investors appear focused on the company’s weak guidance, which it says is due to the “lumpiness” of government work.

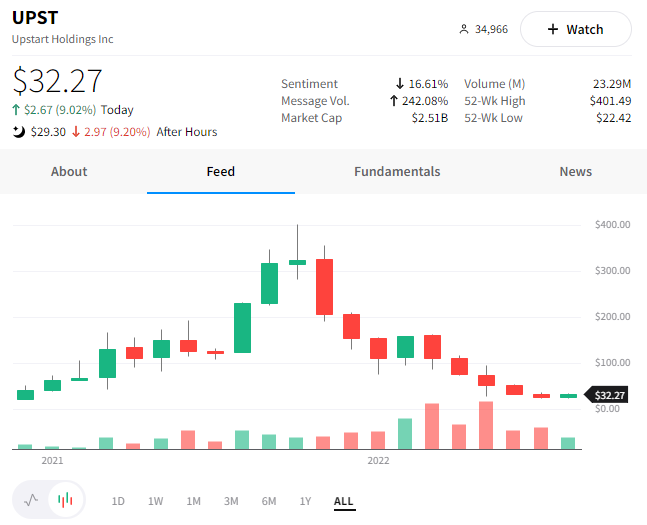

Lastly, another retail favorite, Upstart, rallied 9% ahead of its earnings before giving it all back (and more) after the report. 👎

Despite the optimism from investors throughout the day, the company missed earnings and provided Q3 guidance below consensus estimates.

The lending platform’s co-founder and CEO, Dave Girouard, was singing a familiar tune: “This quarter’s results are disappointing and reflect a difficult macroeconomic environment that led to funding constraints in our marketplace…”

There were some positive earnings too, but these stood out to us. Check out the Stocktwits earnings calendar to keep track of them all. 🗓️