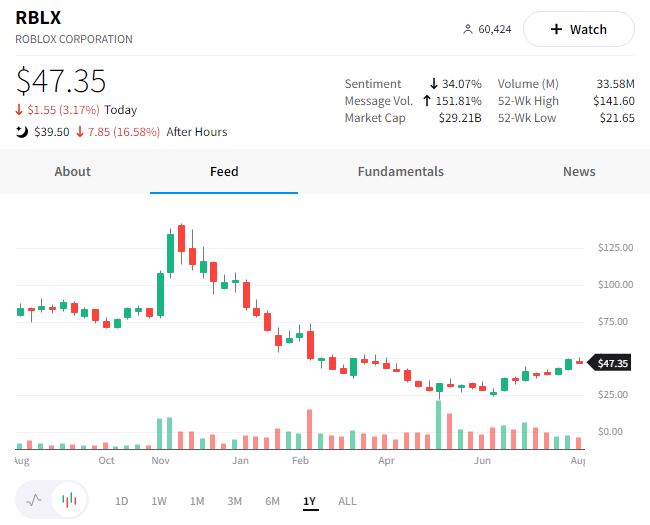

Roblox is learning that investors don’t play games regarding earnings. 🎮

$RBLX shares are down close to 17% after its earnings and revenue numbers were below expectations. The company also reported 52.2 million average daily active users, nearly one million under expectations. Additionally, average bookings per daily user were down 21% YoY to $12.25. 📉

The company says the drop-off is expected given its rapid growth during the pandemic and that its long-term investments will negatively impact earnings in the short term.

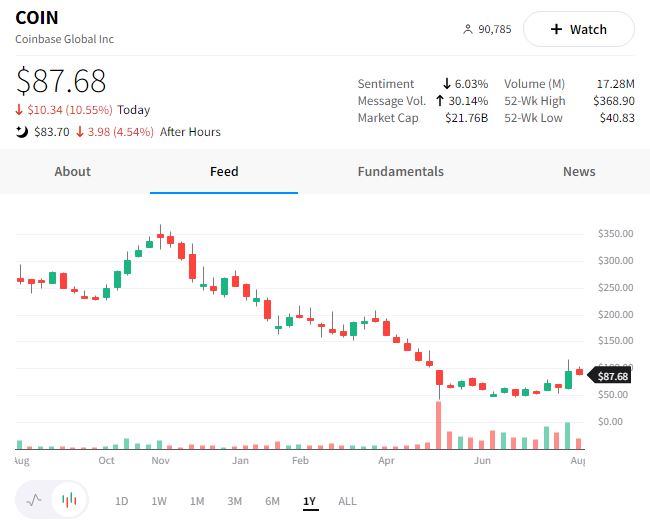

Coinbase investors are feeling the pain after the company reported earnings and revenue below expectations.

The company saw its revenues decline 64% YoY, lowered its full-year forecast for transacting users, and continues to make headcount and other expense cuts. It said that Q2 was a test of durability for crypto companies and a challenging quarter overall. 😮

On the positive, the company focused on the strength of its risk management program during the market’s volatility and the investments it’s making for the future.

$COIN shares were already down 10% today ahead of the report, but fell another 5% after hours. 🔻

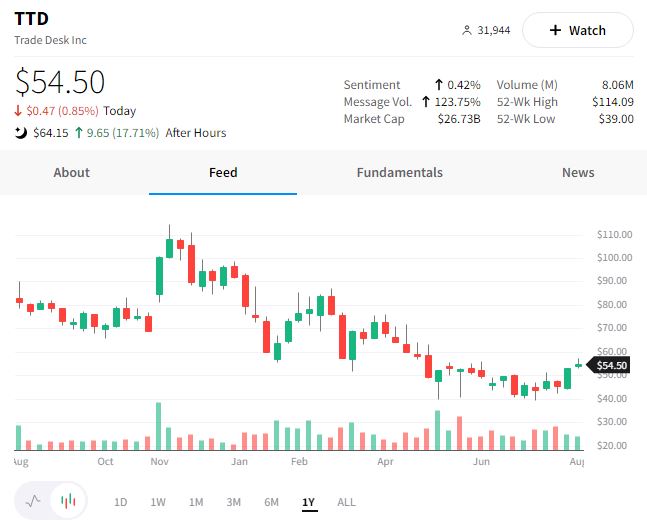

On the positive side of things, The Trade Desk reported revenues that topped expectations and earnings in line with consensus. 📈

The company says internet TV ad revenue growth was a bright spot and expects its partnership with Walmart to boost its full-year growth. Additionally, Google has delayed phasing out internet cookies to 2024, which was a significant headwind for the company.

$TTD shares were up 18% after hours following the news. 👍

Check out the Stocktwits earnings calendar to keep track of all the info. 🗓️