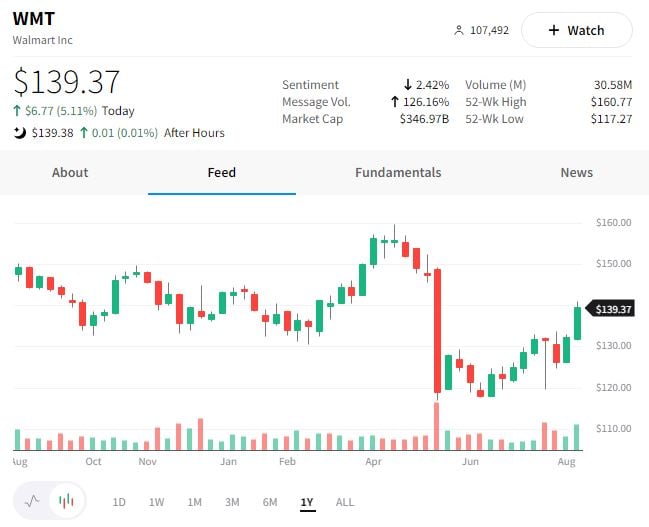

It’s been a tough year for Walmart and retailers, but things may be finally turning the corner at America’s largest retailer. 🤔

Last quarter, it was among the first retailers to sound the alarm about higher costs and changing consumer behavior eating into its profit margins. After that, we saw Target, Amazon, and a whole host of other retailers reporting similar trends. ⏰

Then, last month, the company cut its quarterly and full-year profit guidance, sending the retail sector into another tailspin. In that release, it stated that it aggressively marked down items to clear inventory and that rising food and fuel prices hurt consumer spending. 📉

Today, however, it appears the company lowered the bar enough to simply step over it as its earnings and revenues exceeded analyst expectations. 👍

The company continues to sell through excess merchandise and has “canceled billions of dollars in orders to help align inventory levels with expected demand.” While that’s great for the company, it may not be great for the economy that inflation-strapped consumers continue to shift spending towards necessities and away from discretionary merchandise like electronics and apparel. 🤷♂️

Lastly, the company continues to beef up its Walmart+ membership to compete with Amazon Prime. Yesterday it announced a deal with Paramount+ to add the streaming service to its membership. 📺

Despite the company clearing a low bar, investors cheered the results sending the stock up 5.11%.

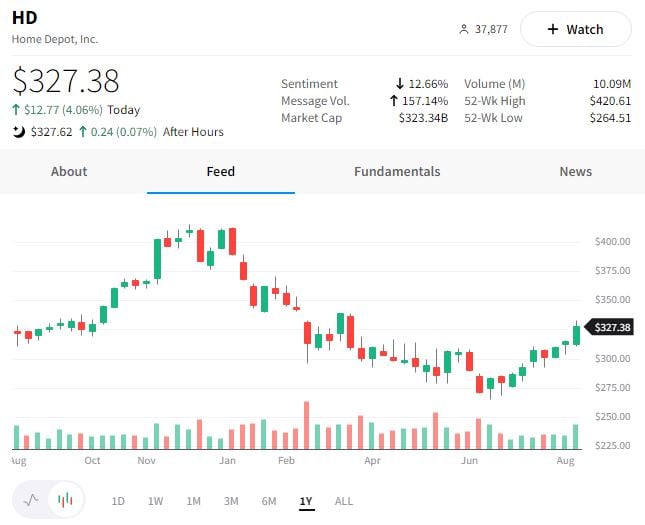

Despite all the weak housing data reported this year, Home Depot’s second-quarter earnings and revenues beat analyst expectations. 📈

The company saw EPS of $5.05 vs. $4.94 expected and revenues of $43.79 billion vs. $43.36 billion expected.

Same-store sales of 5.8% also topped expectations of $4.9%, driven by a higher average ticket and lower transaction volumes. Both pro and DIY sales growth was positive, showing that people are still prioritizing home improvements despite a weaker macroeconomic environment. 🧰

We’ll have to see if the economic backdrop affects consumer behavior through the rest of the year, but so far, the company says project backlogs are still healthy, and customers aren’t yet trading down to less expensive items.

Investors seemed pleased with the results, as the stock rallied 4.06% today. 👍

We’ll get more information about the state of retail and the economy when Target and Lowe’s report tomorrow before the bell. 🔔