The athleisure retailer Lululemon is jumping after reporting better-than-expected earnings and revenues. Its adjusted EPS was $2.20 vs. $1.87 expected, while revenues were $1.87 billion vs. $1.774 billion expected. 💪

Other key metrics include same-store sales growing 23%, well above estimates of 17.6%. Additionally, store traffic rose 30%, and e-commerce traffic was up over 40%, which it hopes to boost further with its membership program.

While other retailers struggle with unwanted inventory, Lulu boosted its inventories by 85% YoY in anticipation of a strong holiday shopping season. Additionally, its higher-income customer base has weather inflationary and economic pressures better than lower and middle-income consumers. 🛍️

As a result, the company raised its full-year earnings and revenue guidance and maintained the long-term outlook it outlined in April.

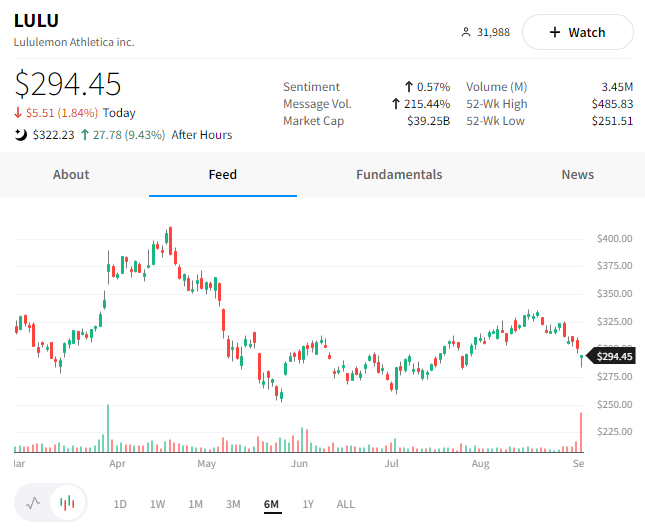

Given the slew of bad news from other retailers, investors were pleasantly surprised, sending the stock up nearly 10% after hours. 📈