It’s a very slow time for earnings, but some stocks are still on the move. One of those is the manufacturing services company, Jabil Inc.

The company’s fiscal fourth-quarter earnings and revenues were above expectations. Adjusted earnings per share were $2.34 vs. $2.15, and revenues were $9.03 vs. $8.39 billion.💪

Additionally, the company provided upbeat guidance. It now expects first-quarter EPS of $2.00 to $2.40 and revenue of $9.0-$9.6 billion, beating expectations of $8.93 billion. And to top it off, the company authorized a $1 billion share buyback, which is ~12-13% of its current market cap.

Investors appear happy with the results, sending $JBL shares up 2.24% in a tough tape. 👍

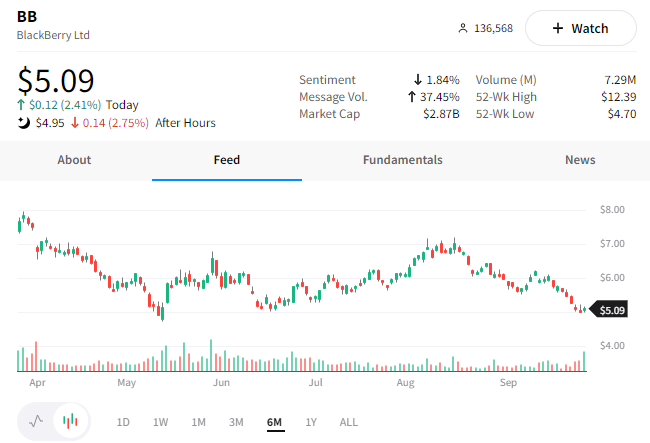

Meanwhile, BlackBerry shares fell 3.54% after hours despite the company beating expectations.

The cybersecurity and “Internet-of-Things” company reported an adjusted second-quarter loss of 5 cents per share, 2 cents better than estimates. Additionally, its revenue of $168 million was above estimates of $162.4 million. 👍

While the results beat expectations, the company’s overall trajectory remains unclear. Investors in the “meme stock” appear to be losing patience in the turnaround story, especially in the challenging macro environment.

Like the rest of the market, shares of $BB are trading near their year-to-date lows. We’ll have to wait and see how it reacts throughout the rest of the week. 🤷