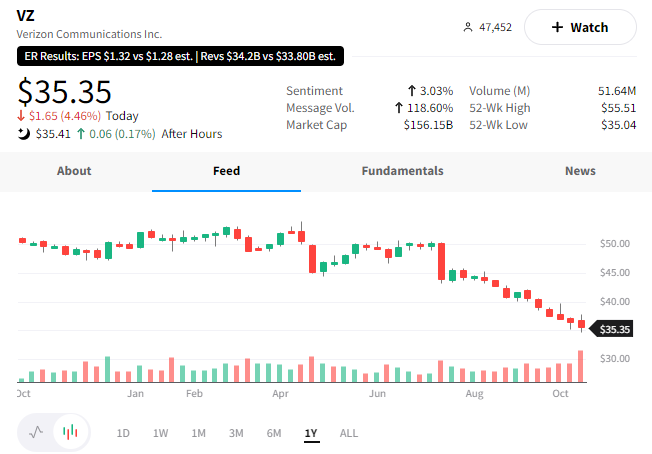

It’s been a tough environment for telecom stocks, so let’s take a look at how Verizon and AT&T fared after reporting earnings.

Its adjusted earnings per share of $1.32 and revenue of $34.2 billion were above estimates of $1.29 and $33.8 billion, respectively.

While its headline numbers seemed to beat expectations, its lackluster subscriber numbers were in focus. Analysts expected a gain of 32,000 postpaid phone subscribers and a loss of 7,000 consumer lines. However, the company only added 8,000 postpaid subscribers and lost 189,000 consumer customers. 👎

The lack of growth was a concern for investors heading into the report, and these numbers confirmed their fears. As a result, $VZ shares fell 5% to their lowest level since 2013.

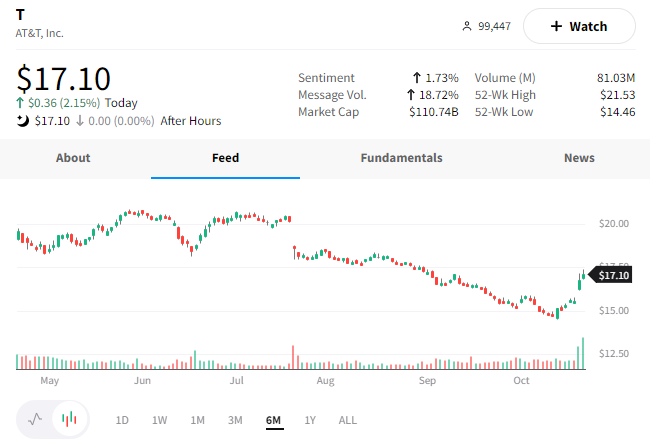

On the other hand, AT&T investors caught a break after the company reported better-than-expected numbers yesterday. 👍

Its adjusted earnings per share of $0.68 beat the $0.61 expected, while revenues of $30 billion beat estimates of $29.8 billion.

Unlike Verizon, the company added 708,000 postpaid wireless phone customers, well ahead of the 552,000 expected. Additionally, it added 338,000 fiber broadband subscribers vs. the 330,000 expected. While the company still has a lot of work to do, stabilization in these numbers is giving investors some hope.

$T shares had their best week since 2020, rising 14% after touching their lowest levels since 1995. 🔺

Ultimately, in this competitive space, subscriber numbers rule the day. With both of these stocks boasting a high dividend yield and being well off their all-time highs, we’ll have to see if investors step in or if they continue to avoid the space. 🤷