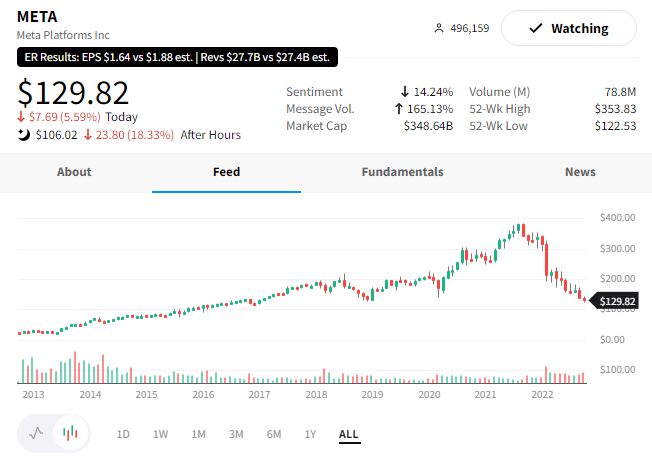

Facebook’s parent company Meta cannot catch a break these days. The stock is currently down 18% after hours, on top of the 5% it lost in the regular trading session. 😮

And why is it down? Because the company is pouring money into its Metaverse vision while its core business is slowing down.

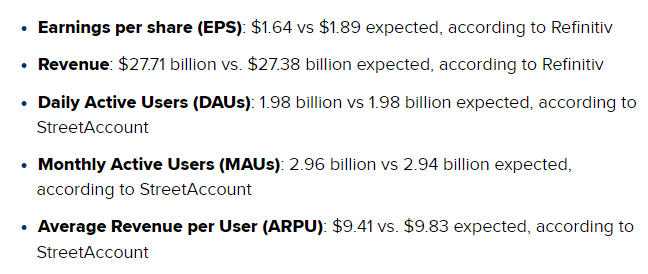

Let’s get into the numbers with a great summary chart from CNBC.

While the company met estimates for revenue, daily active users, and monthly active users, its earnings and average revenue per user missed.

The company also reported its second quarterly revenue decline, and many analysts expect the current quarter to be its third. The company is battling a broader slowdown in ad spending, Apple’s iOS privacy update, and increased competition from TikTok and other short-form platforms. As a result, it said it expects revenue for the current quarter to be between $30-32.5 billion, while analysts expected $32.2. 📉

And while revenue growth continues to slow, the company’s margins are getting wrecked by its Metaverse spending. While the Metaverse may be imaginary, the losses are real..and adding up big time. The company’s operating margin was nearly half of what they were last year, down to 20% from 36%.

Meanwhile, revenues from its Reality Labs unit fell nearly 50% YoY, while its loss increased by over $1 billion. That brings the unit’s total losses for the year to $9.4 billion. And there’s no end in sight. The company says it expects those losses to continue growing in 2023, leveling off in 2024.

Alphabet and other major players in the ad space signaled that the ad slowdown might just be beginning. That’s a severe concern for Meta investors who see the company dumping profits into a virtual reality venture that likely won’t see any return for years to come. 📆

The company is making cuts to preserve capital in the tougher macro environment, but clearly not enough to satisfy investors. Meta expects its headcount to remain flat from the current quarter through the end of 2023.

Many expect Meta’s struggles to continue in an environment where the market is punishing long-term growth efforts in favor of more profitable/conservative bets. We’ll have to wait and see if anything changes over the coming days as investors digest the quarterly results. But for now, the skeptics remain on the right side of the trade. 🤷