Another software stock’s investors are having to Take-Two aspirins for the growth hangover they’re currently experiencing. 🤢

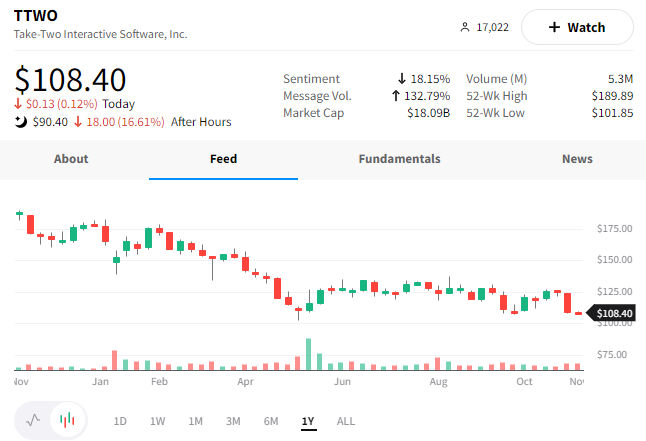

That’s because $TTWO shares are down 16% after reporting weaker-than-expected results and cutting its outlook.

The company reported a loss of $1.54 per share, with revenues of $1.5 billion missing the $1.55 billion expected. But where things really turned south was its forward guidance.

Its fiscal 2023 net bookings will now be $5.4-$5.5 billion, less than the company’s previous midpoint expectations of $5.77 billion. And its fiscal 2023 net loss will be $631-$674 million, significantly higher than the $398-$438 million loss it previously forecasted. 😨

This weakness’s primary driver is the broader gaming slowdown after two years of solid growth during the pandemic. The company’s updated forecast reflects changes to its pipelines, FX rate fluctuations, and a more cautious view of the macro backdrop.

Investors weren’t playing any games with this earnings report, sending shares down 17% to their lowest level since April 2019. 🔻