Yesterday several traditional retailers delivered an earnings surprise. And today, we saw similar action from Foot Locker. 🤩

Let’s take a look…

The shoe retailer reported better-than-expected Q3 results despite earnings and revenue falling 34% and 1%, respectively.

The company’s adjusted earnings per share of $1.27 beat the $1.11 expected. Meanwhile, revenues of $2.17 billion exceeded the $2.09 billion analysts estimated. This quarter’s results helped reassure investors that its inventory mix is in a healthy position and that it’s well-prepared for the upcoming holiday shopping season.

The company also seems to think so, raising its full-year earnings outlook from $4.25-$4.45 to $4.42-$4.50. It now expects total sales to decline by 4%-5% vs. the 6%-7% drop previously expected. And comparable sales should fall by 4%-5% vs. its previous estimate of 8%-9%. 🔺

Like other mall-based retailers, Foot Locker remains in a tough long-term position, especially as the economy weakens. With that said, in this environment, even marginal earnings improvements like those today are a breath of fresh air to investors.

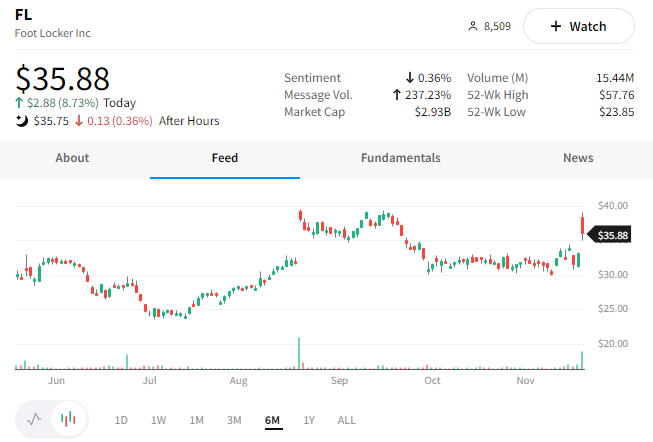

As a result, we saw $FL shares rise nearly 9% today. 📈