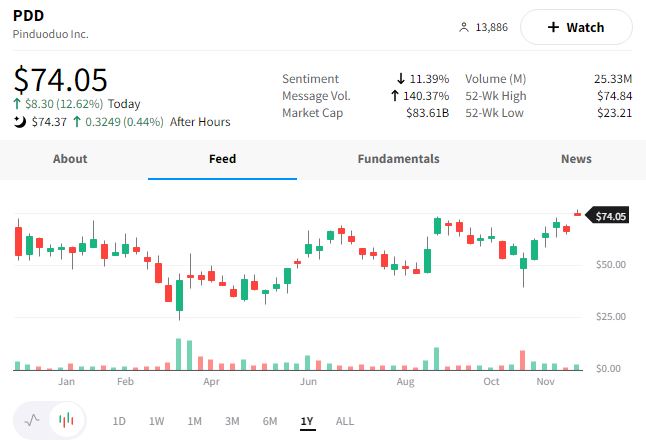

Shares of Chinese e-commerce company Pinduoduo rose to a 1-year high after beating earnings expectations.

The company saw revenue growth of 65% YoY to $4.99 billion, beating expectations of $4.31 billion. Revenues from online marketing services rose 58%, transactions services 102%, and merchandise sales fell 31%. With that said, its merchandise sales are not a material business line for them. 😮

It also posted a non-GAAP operating profit of $1.729 billion, a 277% YoY jump. From that, it generated $1.64 billion in operating cash flow.

Much like other e-commerce players in China, the company continues to invest in long-term growth despite being weighed down by Covid lockdowns. Investors cheered the positive results and continued to focus on the future. 👍