Not even North Face jackets can keep investors warm from the winter VF Corp. is experiencing. 🥶

The owner of North Face and Timberland reduced its revenue and earnings expectations for the second half of its fiscal year. It now expects full-year revenue to rise 3%-4% YoY, down from its previous forecast of 5%-6%. Its full-year earnings will now be $2.00-$2.20 per share vs. previous guidance of $2.40-$2.50 just a few weeks ago. 🔻

Driving the reduced financial outlook is weaker than anticipated demand, especially in North America, where there are fewer sales and more order cancellations. As inflation squeezes consumers, they buy less apparel, especially those on the higher end of the price scale, like VF Corp.’s products.

Additionally, the company announced its chairman and chief executive is retiring. Board member Benno Dorer will serve as interim CEO while they search for a replacement. 🔍

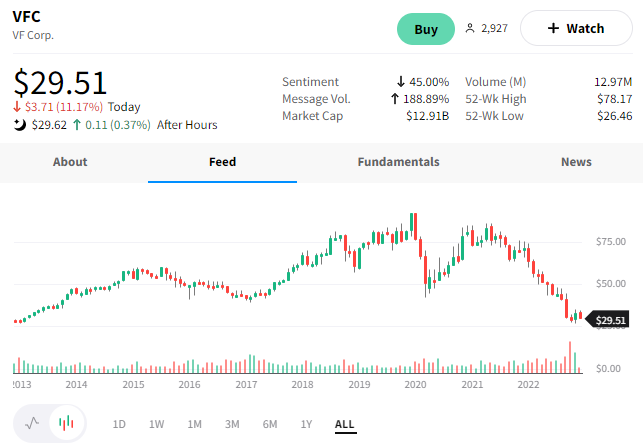

The news sent $VFC shares down 11% today as it hovers near its lowest level since 2013. 📉