In addition to those discussed above, several other stocks moved on earnings today. Let’s recap.

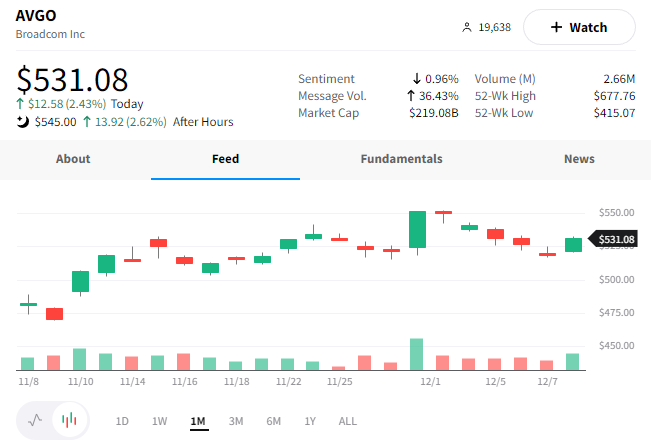

Lululemon lost its leggings this quarter. The stock was down as much as 10% despite beating earnings and revenue expectations.

Net revenue increased by 28%, and gross profits jumped by 25% to $1 billion. And comparable store sales of 22% beat the 19% expected.

However, $LULU shares are falling on weaker-than-expected fourth-quarter earnings and revenue guidance.

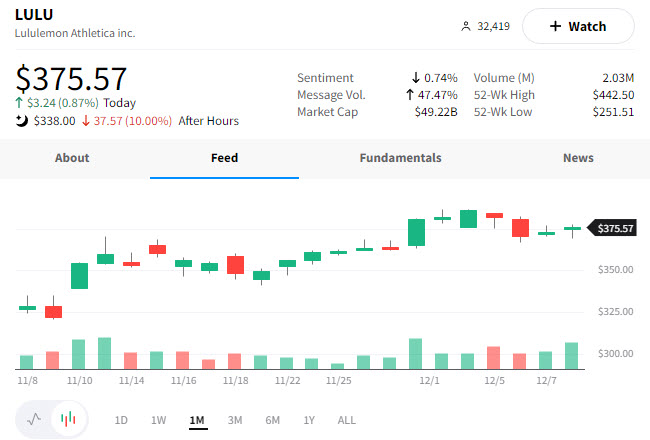

Docusign looks more like Docu-win today after it reported better-than-expected earnings and revenue.

The third quarter was a loss for Docusign, but that’s not what investors were focused on. Total revenue and subscription revenue were higher by 18%, and a 27% jump in professional services and other revenue YoY.

With all the bankruptcies from the dumpster fire that the crypto market has been in, maybe Docusign has been extra busy. But, more seriously, any improvements in the struggling software business are a welcome sign for investors.

As a result, investors pushed $DOCU shares higher after hours to the $50 mark, a +15% gain. However, it’s fallen a good amount to the $45 and $46 range (+5%) since then.

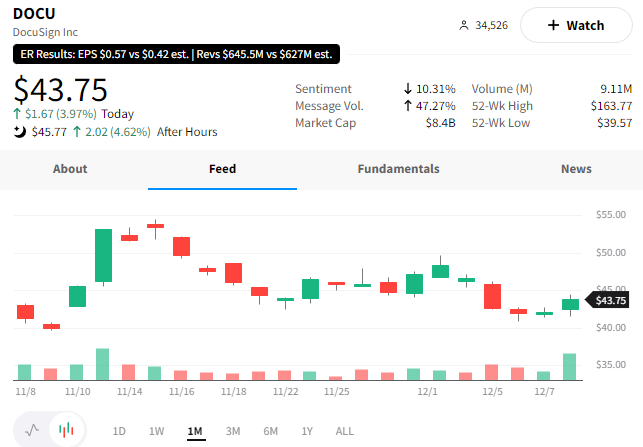

Broadly winning is the phrase to describe Broadcom after its earnings came out.

Revenue rose 21% YoY to 8.93 billion, and earnings per share of $10.45 also beat expectations.

Investors were happy to see the positive results despite the drop in smartphone shipments this year. The company expects its VMware deal to grow its software business, helping diversify it away from harder-hit areas of the chip market industry. As a result, its first-quarter revenue guidance was boosted by 16%, raising its dividend by 12%.

$AVGO shares are up about 4% after hours.