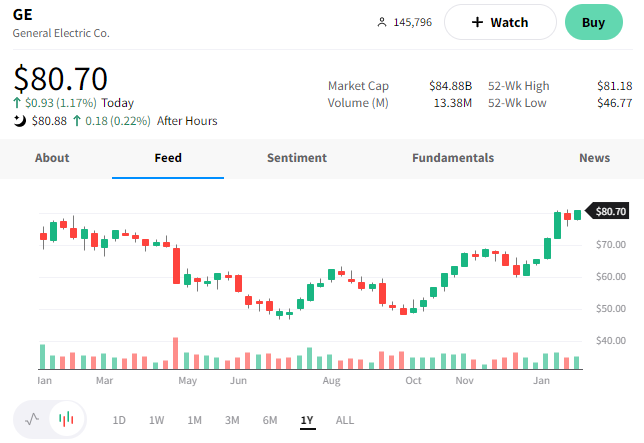

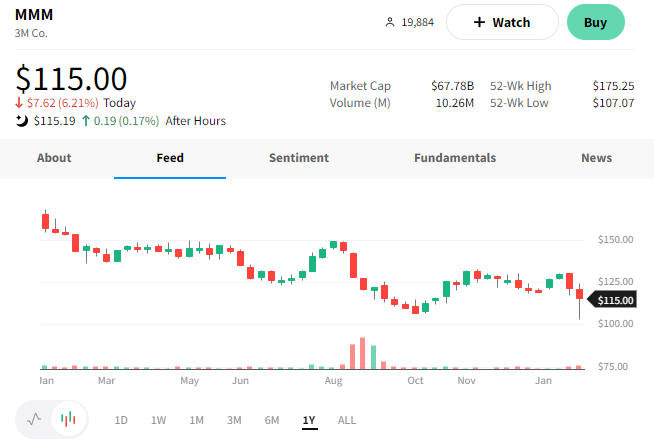

Heavyweights 3M and General Electric reported earnings today, helping move the industrial sector.

Let’s see what they had to say… 👀

3M reported adjusted earnings per share of $2.28 vs. the $2.36 expected, while revenues of $8.1 billion met expectations.

Within its report, it shared a pessimistic outlook for the economy and consumer spending in 2023. As a result, it issued full-year guidance of $8.50 to $9.00 per share, well below the $10.20 analysts are estimating.

The company also announced that it’s laying off roughly 2,500 manufacturing employees. Economic data has shown a significant decline in manufacturing activity, and we’re now starting to see it show up in major companies’ earnings. 🏭

Lastly, 3M continues to struggle with lawsuits over the potentially faulty earplugs it sold to the military. That continues to be a significant overhang for the company.

As a result of the macro uncertainty and operating risks 3M faces, $MMM shares traded down about 6% on the day. 📉

Meanwhile, General Electric reported better-than-expected earnings in its first report since January’s health care business spinoff. 📝

Its adjusted earnings per share of $1.99 beat the $1.15 expected. And revenue of $21.786 billion topped the $21.558 billion expected.

The company’s commercial aviation unit continues to see robust demand for its jet engines and power equipment as the aviation industry recovers. That’s broken down into aerospace segment revenue (+25%) and profit (+17%) and power equipment revenue (+8%) and profit (+124%). 💪

As for the company’s outlook, it expects revenue growth in the high single digits. It also expects adjusted earnings per share of $1.60 to $2 and free cash flow of $3.4 billion to $4.2 billion.

The one soft spot is its renewable energy business, GE Vernova, which expects a $200 to $600 million loss in 2023. However, investors may overlook that because it expects to spin off its energy business into a separate company next year. So maybe they figure that will be someone else’s mess to fix.🤷

Nonetheless, $GE shares were up about 1%, pushing to one-year highs on the news. 📈