Another quarter, another post about Snap’s disappointing earnings results. In what seems to be a tradition at this point, the company missed revenue expectations but beat on earnings.

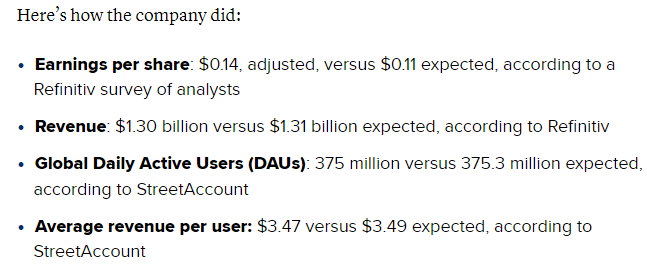

CNBC recaps the key numbers below:

The challenging macro environment has pressured ad sales and caused many companies, including Snap, to retrench and manage expenses. Given the macroeconomic headwinds, platform policy changes, and increased competition that executives blamed for current results aren’t going anywhere, it could be another tough year for the company. 😬

Additionally, the company declined to provide guidance for the third straight quarter. Instead, it told investors that it’s refocusing investments to concentrate on growing community and engagement, accelerating and diversifying its sales growth, and developing augmented reality technologies.

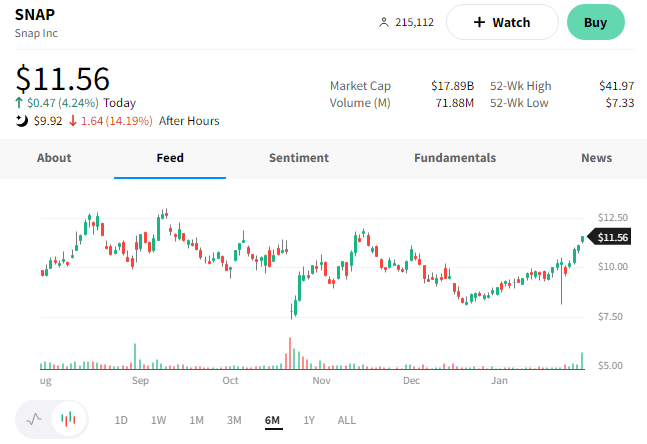

Essentially, that means they’re trying to run a better business. So far, investors are disappearing faster than the app’s messages, with $SNAP shares falling 14% after hours. 📉

Meanwhile, Spotify managed to deliver fourth-quarter results that were “music to investors’ ears.” 🎧🎶

The company’s loss per share of 1.40 euros was wider than the 1.27 euros expected. But revenues of 3.17 billion euros topped estimates by a hair.

However, what investors were focused most on was Spotify’s 489 million monthly active users, which was up 20% YoY. This included 33 million net additions in the quarter and 205 million paid subscribers, which is up 14% YoY.

Executives continue to cut costs and invest in advertising, with its ad-supported revenue growing to account for 14% of total revenue. That growth was driven by podcasting, an area in the company that’s recently struggled to gain traction in despite its significant investments. 🎙️

While the company still has work to do, investors seem to think it’s on the right path. $SPOT shares rose nearly 13% following the news. 📈

In addition to the above, several other tech names were on the move. 👀

Electronic Arts plunged more than 10% after its results and forecast were below consensus estimates. Executives expect layoffs and shelved mobile versions of two of its popular games.

Match Group fell nearly 10% after the company’s first-quarter forecast failed to impress.

Western Digital dropped nearly 6% after the company’s forecast fell short of expectations.