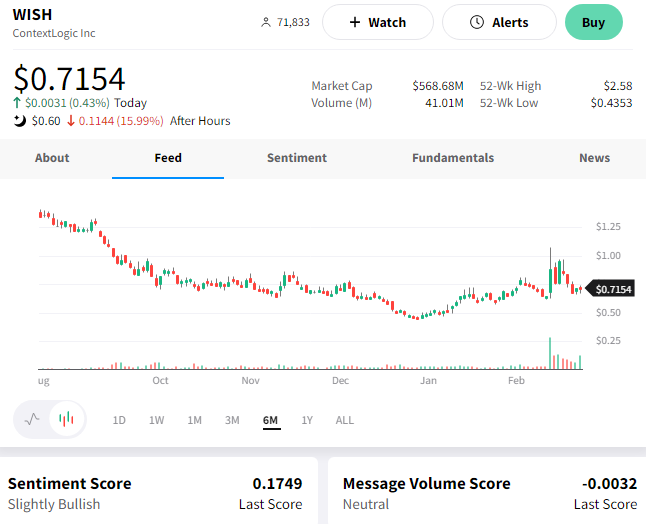

Two weeks ago, we spoke about Wish, formally known as ContextLogic, after Citron Research published a bullish view on the stock. 🐂

Since that initial pop, its share price has trickled back down. But today, results came in worse than expected, sending shares sharply lower.

Revenues of $123 million fell 57% YoY, broken down into these segments: 🛒

- Core Marketplace revenues of $36 million (-74% YoY);

- Product Boost revenues of $10 million (-64% YoY); and

- Logistics revenues of $77 million (-37% YoY)

Its net loss per share of $0.16 also rose from $0.09 in the prior year. Additionally, free cash flows of -$109 million more than doubled from the previous year’s -$50 million.

While executives harped on the company making progress in its transformation strategy, the mounting losses and dwindling free cash flow are a major concern for investors. Its efforts to reduce costs by prioritizing initiatives, better-aligning resources, and improving operational efficiencies have yet to produce the desired results. 🤷

As we just heard from Wayfair and other retailers (online and brick-and-mortar), the current environment remains extremely challenging. As a result, investors are likely concerned about the company’s ability to navigate a turnaround with all of the headwinds it’s facing. 😬

We’ll have to wait and see what the coming quarters have in store. But for now, investors wish they sold $WISH shares sooner, as the stock drops 16% after hours.