AMC investors can’t catch a break, as the stock falls after hours despite beating earnings and revenue expectations. 🤷

The movie-theater chain posted revenues of $990.9 million, down from $1.17 billion a year earlier but above the $977.7 million expected. Meanwhile, its fourth-quarter loss per share of $0.26 doubled from $0.13 during the same quarter of 2021.

Box-office hits like “Avatar: The Way of Water” and “Black Panther: Wakanda Forever” drove the beat, luring moviegoers back to theaters. Executives expect the recovery to continue in 2023, with Hollywood expecting to release 75% more movie titles than in 2022. Great content is what the company believes will help bring people back in their seats. 📽️

With that said, the company is also working hard to diversify its revenue streams. While most of its efforts are focused on increasing the value proposition of its AMC Stubs membership program, it’s also branching out to other opportunities.

For example, it’s partnering with Walmart to release a new retail popcorn line in March and rolling out a new movie ticket pricing model based on the seat’s location. 🍿

With that said, concerns about its core business remain. Global attendance decreased from 60 million patrons in Q4 2021 to 49.5 million last quarter. And CEO Adam Aaron predicted that the industry-wide box office would not return to pre-pandemic levels before 2024 or 2025 “at the earliest.”

That comment spooked investors who are worried that the company’s remaining cash and debt load could prevent it from surviving until the market turns more favorable. Cineworld and other competitors recently filed for bankruptcy protection, further stoking AMC investors’ anxiety. 😬

The overhang of the company managing its capital structure also weighs on the stock. The company’s March 14th shareholder vote proposes a reverse stock split and APE unit conversion that would make it easier for the company to raise fresh funding. However, scheduled court hearings in April will delay its ability to raise new debt for now. 🗳️

Overall, the report left investors with a lot to digest. Despite the positive results last quarter, concerns about the company’s ability to navigate this challenging environment in its current state remain investors’ key concern. The investing community’s support of AMC shares has bought it additional time to turn its business around, but some investors apparently feel its time is running out.

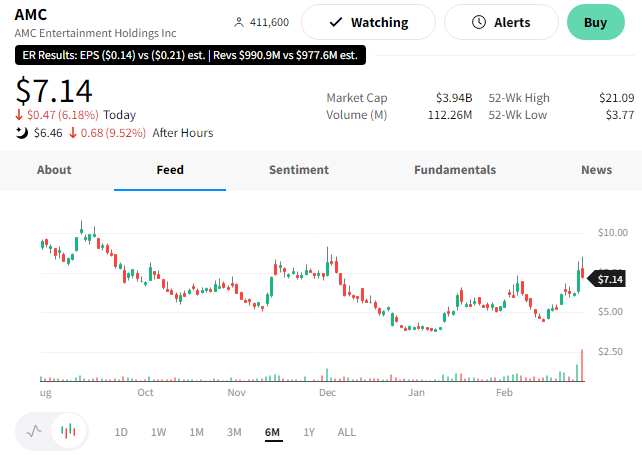

$AMC shares were down nearly 10% after hours, adding to their 6% decline during regular trading. 📉