After weak results and forecasts from Walmart and Home Depot last week, Target added to the market’s concern about consumers. ⚠️

The retailer reported holiday-quarter earnings and revenue that topped expectations. Adjusted earnings per share of $1.89 and revenue of $31.4 billion beat the $1.40 and $30.72 billion Wall Street consensus. It’s important to note that those expectations had been ratcheted down over the last year as the company adjusted to the changing environment. ↘️

Same-store sales also rose 0.7%, outpacing the 1.6% decline analysts expected.

Its revenue was up 1% YoY, but shrinking profit and margins caused executives to provide a conservative full-year outlook. They expect same-store sales to range from a low single-digit decline to a low single-digit increase for the fiscal year 2023. They also expect full-year earnings per share of $7.75 to $8.75, well below the $9.23 consensus estimate. 🔮

CEO Brian Cornell said it remains a challenging environment. Consumers continue to focus on necessities over discretionary purchases, with groceries, beauty items, and household essentials boosting the company’s sales. The company’s conservative forecast reflects an environment where stubbornly-high inflation, rising interest rates, and economic uncertainty weigh on the consumer.

Like Walmart, its private-label brands also benefitted as consumers looked for bargains. The spending shift toward lower-margin items, plus the company’s efforts to clear out unwanted inventory, continued to pressure its operating margin. Last quarter’s number was 3.7%, down from 3.9% in Q3 but above the 3.1% expected by analysts. 🔻

The company expects to return to its pre-pandemic operating margin of 6% beginning in the next fiscal year, though it could come later depending on prevailing economic conditions.

Overall, the retailer painted a similar picture as its peers. Last year was particularly difficult as they adjusted late to changing economic conditions. However, this year they appear better positioned to weather the challenges ahead. 🌩️

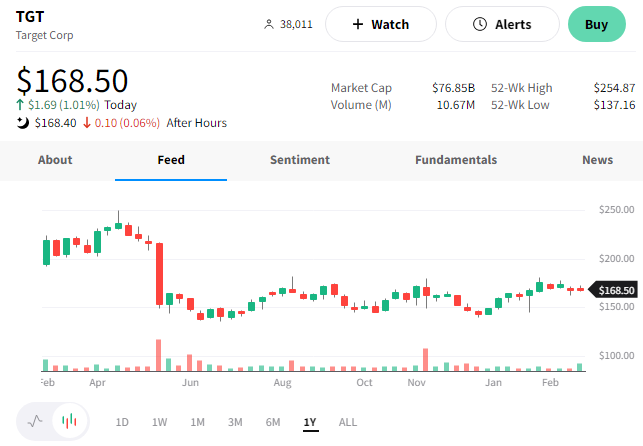

$TGT shares were up about 1% on the mixed results. 🤷

While we’re discussing the industry, let’s see how auto parts retailers AutoZone and Advanced Auto Parts fared. 🚗

AutoZone’s earnings per share of $24.64 and revenues of $3.69 billion beat the expected $21.96 and $3.559 billion. Domestic same-store sales also rose 5.3%, topping the 4.0% estimate. However, commercial same-store sales of 13.6% fell short of the 15.8% estimate.

Advanced Auto Parts’ earnings per share of $2.88 and revenue of $2.47 billion topped the $2.41 and $2.421 billion consensus estimates. This marks its second straight quarter of accelerating sales growth, albeit a very slight one. Additionally, CEO Tom Greco announced he’s retiring at the end of the year, and the board is looking for his replacement.

The reports follow strong results from O’Reilly Automotive and Genuine Parts, as the aftermarket car business remains robust. All the stocks mentioned, with the exception of Advanced Auto Parts, are trading near their all-time highs. 🤩