It was a busy day for electric vehicle earnings, so let’s quickly review how they did. ⚡

Chinese EV firm Nio reported weaker-than-expected results before the bell.

Its net loss per share of $0.44 and revenues of $2.329 billion missed the $0.26 and $2.462 billion consensus estimates. The company’s vehicle and gross margins fell sharply YoY, with executives citing inventory provisions, accelerated depreciation on production facilities, and losses on purchase commitments for the existing generation of EVs.

The company’s weak outlook also spooked investors. It now expects current-quarter revenue of $1.584 to $1.674 million, well below the $2.505 billion expected. 🔻

$NIO shares fell 6% and closed at their lowest level since July 2020. 📉

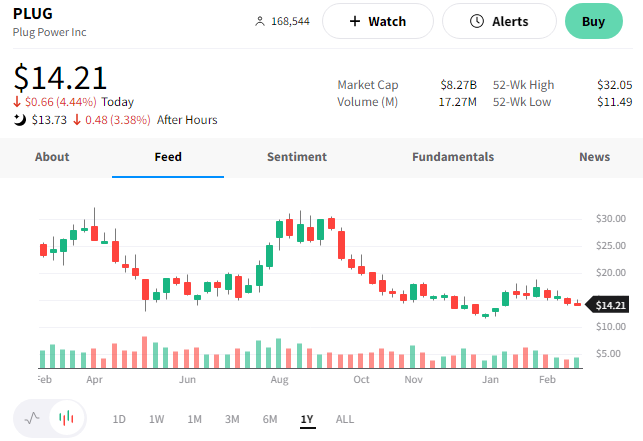

Hydrogen fuel cell producer Plug Power reported a wider-than-expected adjusted loss, while revenues of $221 million fell short of expectations. Gross margin improved from -54% to -36% as natural gas prices decreased significantly.

The company forecasts $2.1 billion in sales and 25% gross margins in the fiscal year 2024, $3.3 billion and 30% in 2025, and $5 billion and 30% in 2026.

Despite the optimism from management, $PLUG shares were down 8% on the day. 🪫

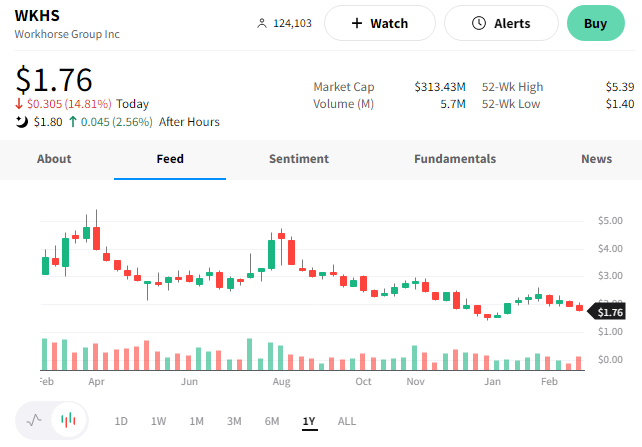

Finally, the last-mile-electric-vehicle company, Workhorse, posted a $0.24 loss per share on revenues of $3.4 million. Both numbers fell short of the -$0.18 and $10.8 million expected.

$WKHS shares fell 15% on the day. 👎