The American manufacturer of licensed and limited pop culture collectibles is best known for its “Funko Pop” bobbleheads.

But unfortunately for investors, the only thing popping was its share price (and not in a good way). 🫧

The company’s adjusted loss per share was $0.35, and revenues were $333 million. Wall Street was looking for a $0.10 loss per share and $318 million in revenue.

What alarmed investors was the company’s inventory levels, which soared by 48.1% to $246.4 million. The large amount of inventory caused its selling, general, and administrative expenses (SG&A) to spike 78% in the quarter, as it paid for storage costs and container rentals. To tackle this issue, executives are investing in a new warehouse management system for its distribution center and will reportedly write down $30 million worth of inventory. 📦

Overall, this was not the news investors were hoping for. It’s already a tough environment for discretionary goods makers like Funko, and these operational missteps further exacerbate those challenges. Shares have still not recovered from their earnings miss last November when they fell over 60%. The company drastically cut its outlook back then, but clearly not by enough. 😬

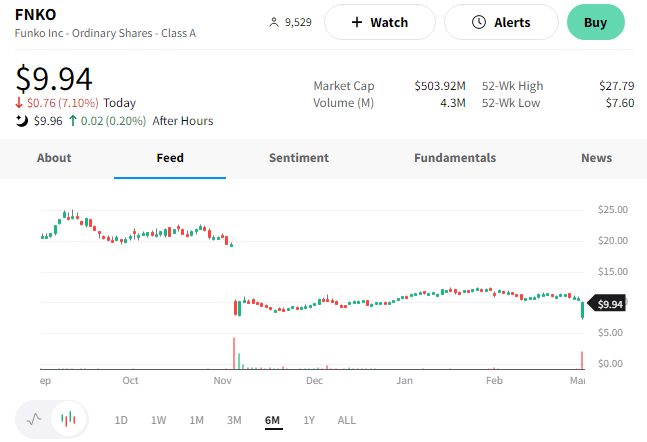

$FNKO shares were down roughly 35% at their lows today but recovered strongly to close down just 7%. We’ll have to wait and see how this plays out in the weeks ahead, but today’s news definitely had investors asking, “what the Funko just happened?” 🤷