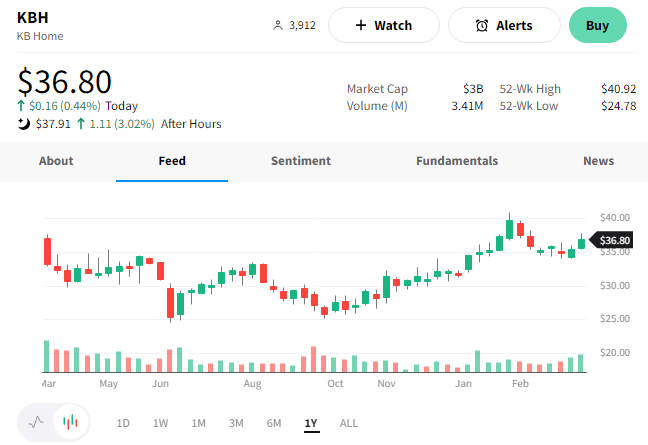

Homebuilder KB Home and another name brought home the goods after hours, reporting better-than-expected results. 👍

KB Home reported first-quarter earnings per share of $1.45, down $0.02 YoY. Analysts had expected $1.17 per share. Meanwhile, revenues of $1.38 billion also topped estimates of $1.32 billion, falling $0.02 billion YoY. 💪

Other relevant stats included:

- Ending backlog down from $5.71 billion to $3.31 billion. In units, it’s down from 11,886 to 7,016.

- Net orders fell 39% to 2,142, and net order value fell 53% YoY to $1 billion.

- The cancellation rate as a percentage of gross orders was 36%. (Up from 11% YoY, but down from 68% QoQ)

- Land and land development expenditures fell 48% YoY to $367 million, with the land investment portion down 86% YoY.

For fiscal 2023, executives forecasted housing revenue of $5.2 to $5.9 billion, an average selling price of $480,000 to $490,000, and a return on equity in the lower double digits. 🔮

Overall, the housing market remains soft, and builders are still dealing with tough comps from last year. However, KB and others are adjusting to the weakening housing market by reducing investment, working through their backlog, and using promotions to pull buyers in. 🏘️

Executives say they’re seeing a slight uptick in demand as the Spring selling season begins. However, the volatility in mortgage rates and the macroeconomic environment remain significant headwinds for the company. 🌬️

Investors appear happy with how the company’s managing the downturn. $KBH shares rose 3%.

While this is unrelated to housing, it’s worth mentioning another name that fared well today.

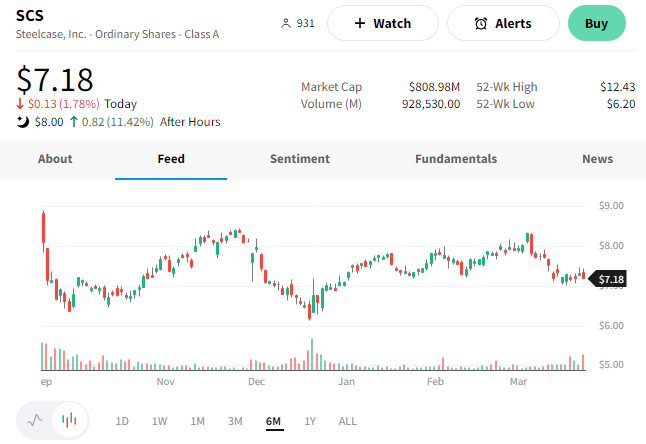

Steelcase is a small-cap industrial company that provides furniture and architectural products in the U.S. and abroad. Its adjusted earnings per share of $0.19 and revenues of $801.7 million both topped estimates by $0.08 and $51 million, respectively. Its full-year guidance also beat expectations. 🏋️

$SCS shares rose over 11% on the news, though they’re fading a bit after hours. 🥀