Our other two stories are pretty beefy today, so we’ll keep Apple’s earnings recap brief. 🤏

In short, it was a bit of a nothing burger. The options market expected a $7 or 4% move in the stock after earnings, but we got a fraction of that. 🤷

Here’s how the company’s key metrics stacked up against analyst expectations:

- Adjusted earnings per share (EPS) of $1.52 vs. $1.43

- Revenue of $94.84 billion vs. $92.96 billion

- Gross margin of 44.3% vs. 44.1%

As for segment revenue, Mac, iPad, and services fell short of expectations:

- iPhone $51.33 billion vs. $48.84 billion

- Mac $7.17 vs. $7.80 billion

- iPad $6.67 billion vs. $6.69 billion

- Other Products $8.76 billion vs. $8.43 billion

- Services $20.91 vs. $20.97 billion

Analysts were happy to see Apple’s iPhone sales grow 2% despite a 15% contraction in the broader smartphone industry. The company previously warned that its Mac and iPad businesses would decline as the broader PC and tablet market remains weak. The strength of the iPhone’s segment and continued growth in its high-margin services business more than offset that weakness. 📱

As usual, Apple didn’t provide any formal guidance during the release. It typically provides additional color on its outlook during the earnings call. With that said, Tim Cook is optimistic about Apple’s prospects in India, both from a sales perspective and a manufacturing one. Additionally, he said Apple is not considering mass layoffs at this time and considers that a “last resort.” 👍

Additionally, Apple’s board authorized $90 billion in share buybacks and dividends. That resulted in the company raising its dividend by 4% to 24 cents per share. 🤑

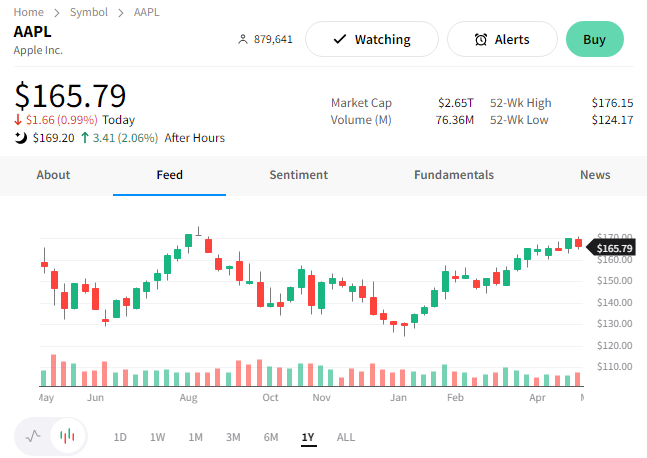

$AAPL shares are up roughly 2% after hours. 🍏