The biggest retail story today was from Home Depot, which reported its worst revenue miss in 20 years and cut its full-year outlook. 😧

The home improvement retailer’s adjusted earnings per share of $3.82 topped the $3.80 expected. On the surface, that looks all good and well. But its sales numbers are where things fell apart.

Chief Financial Officer Richard McPhail said the company anticipates 2023 as a “year of moderation” following an increased appetite for home improvement during the pandemic. Although the state of the consumer remains healthy regarding income and balance sheets, there is a shift from larger projects to smaller ones. 🏡

That resulted in revenues of $37.26 billion, which fell well short of the $38.28 billion anticipated by analysts. Comparable sales fell 4.5% in Q1, with lumber accounting for more than two percentage points of that decline. Executives also mentioned wetter and colder weather conditions in the western U.S. weighed on results.

Customer transactions fell 5%, with an average ticket of $91.92 staying flat. That’s a significant change from previous quarters, where price increases more than offset volume declines. 🤔

Sales trends were negative overall but were better among do-it-yourself customers vs. professionals. That’s notable, considering most of Home Depot’s business comes from professionals. That contrasts Lowe’s, which has the opposite customer demographic and reports next week. 👷

Overall, executives believe the medium to long-term fundamentals of home improvement are strong.

However, in the near term, the uncertain macroeconomic environment and slow housing market have consumers pulling back on discretionary purchases. Instead, they’re spending more on necessities. And when they do spend discretionary income, it’s going towards travel, dining out, and other experiences instead of home goods.

As a result, they now expect sales and comparable sales to decline by 2% to 5% for the fiscal year and an operating margin of 14% to 14.3%. That’s down from their previous outlook of flat sales and a 14.5% margin. ⚠️

This isn’t a major surprise for those of us tracking retailers every earnings season. For several quarters transaction volumes have been falling. Higher prices offset much of that weakness, but that is no longer. However, the most notable change in this report is management’s acknowledgment of the weakness they had brushed off in previous quarters.

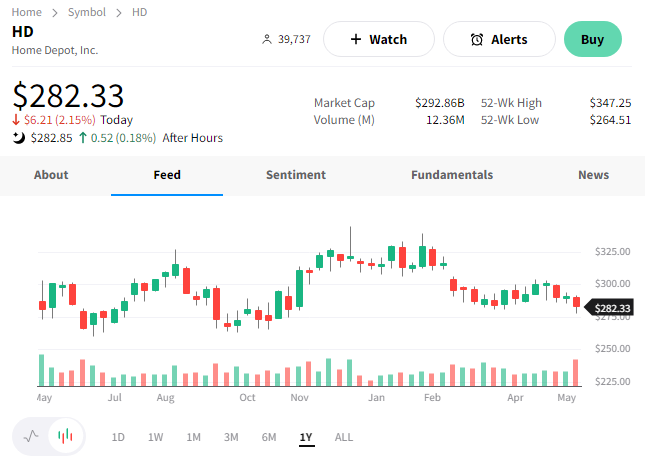

With that said, investors may have priced in the slowdown already. $HD shares remain 35% off their 2021 highs, falling just 2% on the news. 🔻

Time will tell, though. We’ll get more information from Target, Walmart, Lowe’s, and others in the days ahead. 👀