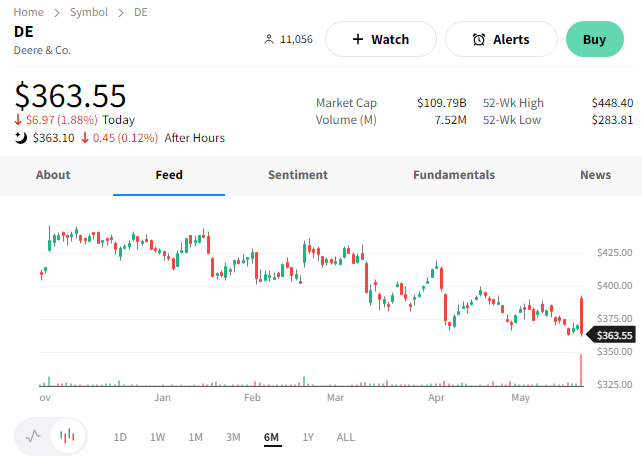

We last spoke about Deere & Co. in February, when shares were trading just below all-time highs. Since then, prices have fallen roughly 15%, and today’s results failed to get it back on track.

The world’s largest farming equipment maker reported earnings per share of $9.65 on revenues of $17.39 billion. Both numbers topped the $8.58 and $14.89 billion anticipated by analysts. 💪

Here’s how that 30% YoY revenue growth broke down:

- Production & precision agriculture sales +52.9% YoY to $7.82 billion

- Small agriculture & turf sales +16.1% to $4.15 billion

- Construction & forestry sales +22.9% to $4.11 billion

Executives remain optimistic about its full-year results. They raised guidance for net income from $8.75 to $9.25 billion to $9.25 to $9.50 billion. They also lifted its Small Agriculture & Turf outlook from flat to +5% and its Construction & Forestry from up to 15%. 📈

They referenced favorable market conditions and an improving operating environment in their outlook. The company and other industrial giants have struggled with supply chain issues. However, this quarter many of these companies these conditions remain far from optimal but are improving.

Higher pricing has been a major tailwind for Deere, but as inflation subsides, some analysts are concerned that could weigh on results. Additionally, they noted some investors may think it’ll be hard for things to get better for the company from here. If a major order backlog and record results can’t push the stock up, maybe many of those bullish expectations are already priced in. 🤔

Whether that’s true remains to be seen, but that’s how the market is currently acting. $DE shares initially rose 7% but closed down 2%. 🔻