Last time we talked about shoe retailer Foot Locker, it was in a precarious position. However, executives were optimistic things were turning the corner. Unfortunately for investors, they were not able to deliver on that optimism during the first quarter.

The company’s adjusted earnings per share (EPS) of $0.70 missed the $0.81 expected. Revenues of $1.93 billion were also below the $1.99 billion expected. 👎

The retailer said it needed to aggressively promote and discount merchandise in order to clear high inventory levels. Retailers far and wide have said discretionary purchases continue to suffer in the current environment. And shoes and clothes certainly fall into that category. 🛍️

Despite the current macroeconomic environment and lower tax refunds, executives had hoped demand would snap back. However, as the quarter went on, it became clear that optimism did not match reality. As a result, executives cut their guidance aggressively. ✂️

Here are their new full-year estimates vs. previous expectations:

- Sales -6.5% to -8% YoY vs. -3.5% to -5.5%

- Comparable sales -7.5% to -9.0% YoY vs. -3.5% to -5.5%

- Non-GAAP earnings of $2 to $2.25 vs. $3.35 to $3.65

- Gross margins of 28.6% to 28.8% vs. 30.8% to 31%

With the many headwinds facing consumers currently, it’s going to be a difficult environment for Foot Locker to perform. It’s expecting to continue the promotional activity to bring in shoppers and reduce inventory. That’s going to weigh on margins and earnings for the foreseeable future. 🔻

Longer-term, the company hopes to continue diversifying its brand mix away from Nike. This quarter that mixes outside of Nike was 35%, up a couple of points since the last year. They’re still pushing to get that number above 40% by 2026. It’s also working to rationalize costs to preserve cash until the environment improves.

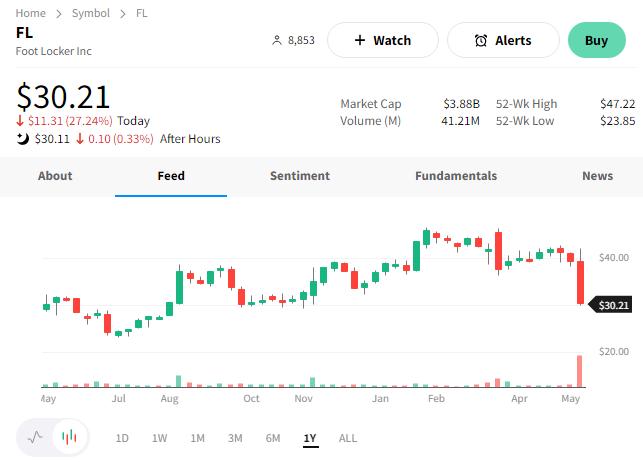

However, what’s missing is a clear strategy on how it’s going to boost sales. As a result, $FL shares plummeted 27%, failing to get a grip among investors. 😬