Shipping stocks aren’t often a topic of conversation, but today’s moves in two stocks brought them into view. 👀

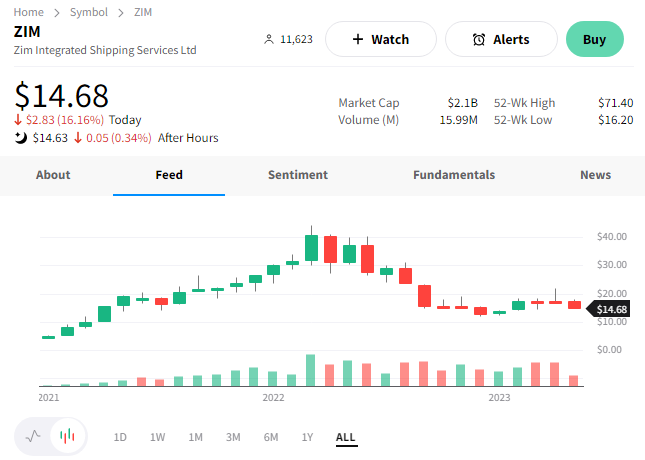

Zim Integrated Shipping Services saw shares fall 17% today on weaker-than-expected results.

Some of the key metrics from the quarter included: 🔻

- Revenues of $1.37 billion (-63% YoY)

- Carried volume of 679,000 TEUs (-10% YoY)

- Average freight rate per TEU of $1,390 (-64% YoY)

- Diluted loss per share of $0.50 (vs. $14.19 per share earnings last year)

- Adjusted EBITDA of $373 million (-85% YoY)

Executives attributed the results to a steep decline in freight rates and weak demand, particularly in the Transpacific trade. Given the weak macro conditions, they expect the near-term environment to remain challenging. That said, they reaffirmed their full-year 2023 guidance of adjusted EBITDA of $1.8 to $2.2 billion and adjusted EBIT of $100 to $500 million.

$ZIM shares are trading at their lowest level since February 2021. 📉

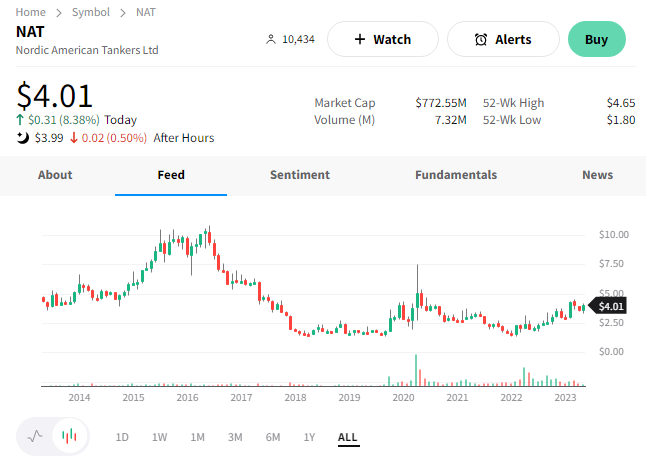

Meanwhile, Nordic American Tankers saw shares rise after reporting results. 🚢

Executives said the average time charter equivalent (TCE) for their fifteen spot vessels during the first quarter was $60,005 per day per ship. Including the four vessels on term contracts, the total average NAT TCE was $51,902 per day per ship.

That’s the second-strongest first-quarter TCE in the company’s 28-year history. And for context, operating costs are about $8,000 per day per vessel. 👍

Some other key stats from the tanker company included:

- Net profit of $0.22 per share and adjusted EBITDA of $67.7 million

- 65% of spot voyages for Q2 have been booked at an average TCE of $42,111 per day per ship

- Dividend hike to $0.15 per share

- Net debt of $168 million, or $8.9 million per ship

Executives remain positive about the future. While last year was focused on Europe’s energy challenge, this year, the reopening of China and the re-emergence of India and the Far East should add demand to an already tight NAT market. ✈️

$NAT shares jumped 8% as they continue to trade near the top of their 5-year range. 🔺