Investors continue to watch retailer earnings for a read on consumers’ health. We heard from several key companies today, so let’s take a look. 👇

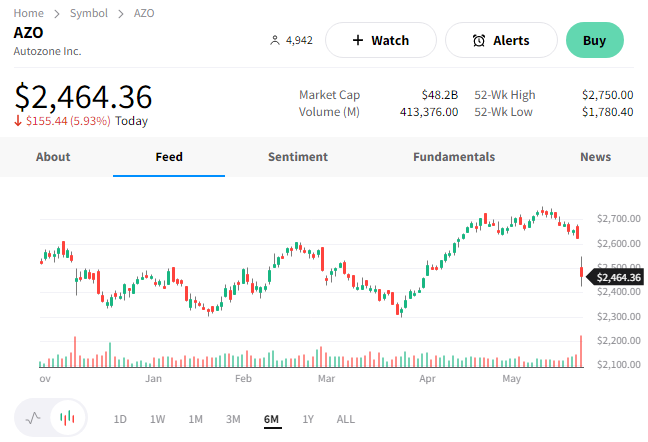

First up is BJ’s Wholesale Club Holdings, which matched earnings and missed revenue expectations.

The membership-based warehouse retailer reported $0.85 per share on revenues of $4.72 billion. That compared to analyst estimates of $0.85 and $4.82 billion in revenues. Same-store sales growth of 5.7% also missed analysts’ 6.1% forecast. 🔻

During prepared remarks, CFO Laura Felice said the company is dealing with an “increasingly discerning consumer environment.” Meanwhile, CEO Bob Eddy said, “We recognize that in today’s environment, consumers remain live in their shopping behavior, and members are more conscious as they continue to work to stretch their dollar.”

Overall, it adds to the cautious view we’ve heard from its competitors. The consumer is still spending but trading down as they shift their dollars towards necessities. And although executives expect the trend of disinflation to continue, consumers believe it’s likely to remain a bumpy economic environment. ⚠️

$BJ shares fell 7% to nearly eleven-month lows.

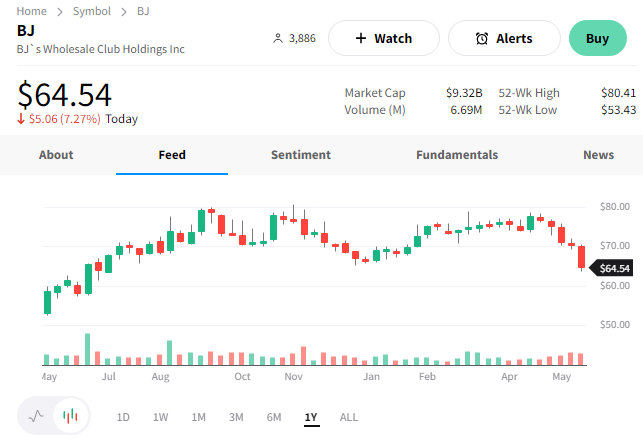

Dick’s Sporting Goods beat expectations but is still falling today. 🤔

Adjusted earnings per share of $3.40 topped the $3.18 expected. Same-store sales matched analyst expectations, rising 3.4%. Analysts say a tax benefit contributed to the earnings beat. However, a narrower-than-expected gross margin decline and healthier inventory levels were encouraging.

Executives maintained their full-year outlook for $12.90 to $13.80 earnings per share, well above the $13.38 analyst consensus view. They recognize the challenging environment for discretionary spending but believe the consumer trend of prioritizing health, wellness, and outdoor activities will continue. It’s all part of the thesis that these purchases have shifted, at least in part, from discretionary spending to necessities. 🚴

$DKS shares initially popped but closed down just over 1%.

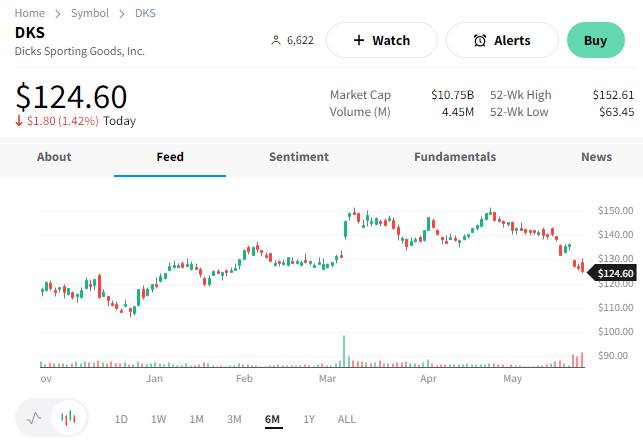

Home improvement retailer Lowe’s beat profit estimates but missed same-store sales forecasts. 📋

Adjusted earnings per share of $3.67 beat the $3.44 expected. Total sales fell 5.5% YoY to $22.35 billion, topping the $21.60 billion estimate. However, same-store sales did decline 4.3%, more than the 3.4% expected.

Like Home Depot, lumber’s price deflation and unfavorable spring weather weighed on results. The company’s Pro and online segments delivered positive comparable sales. However, softer-than-expected demand from the “Do-It-Yourself” segment offset that strength, given it makes up most of Lowe’s customer base.

Executives remain optimistic about the medium-to-long-term outlook for home improvement. However, the near-term economic challenges caused them to pull back their full-year guidance. 👎

They’re now expecting:

- Total sales of $87 to $89 billion (prev. $88 to $90)

- Comparable sales of -2% to -4% YoY (prev. flat to -2%)

- Adjusted operating margin of 13.4% to 13.6% (prev. 13.6% to 13.8%)

- Adjusted diluted earnings per share of $13.20 to $13.60 (prev. $13.60 to $14.00)

Like Home Depot, $LOW shares remain over 20% off their all-time highs. That likely indicates some of this slowdown news was already priced into the stock. Shares rose about 2% on today’s news.

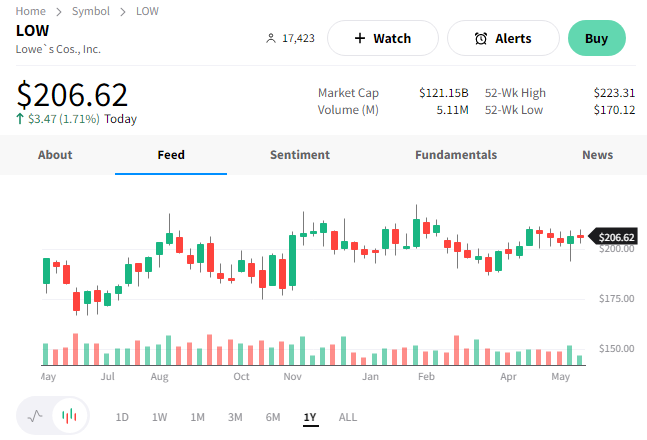

Lastly, AutoZone is pulling back from all-time highs following its earnings results. 🚗

The cart-parts retailer reported adjusted earnings per share of $34.12 on revenues of $4.091 billion. That was mixed compared to the $31.50 and $4.123 billion expected. Same-store sales growth of 1.9% also missed the 4.1% consensus estimate.

Executives said they saw sales weaken materially in March, so investors will be watching to see if that continues into the current quarter. Other retailers have reported similar experiences, which likely added to investors’ concerns. However, management focused on their long-term initiatives that position the company well for future growth. 🧰

$AZO shares fell 6% on the day.