Global financial technology platform Intuit kicked off tech earnings after the bell. 🔔

The company, which owns TurboTax, Credit Karma, Quickbooks, and Mailchimp, missed revenue but beat earnings expectations. Adjusted earnings per share of $8.92 on revenues of $6.02 billion were mixed versus the $8.48 and $6.09 billion consensus views.

The Small Business and Self-Employed segment led the strength. QuickBooks Online Accounting revenue grew 25% YoY, driven by customer growth, higher effective prices, and a favorable product-mix shift. Online services revenue grew 21% YoY driven by Mailchimp, QuickBooks Online payroll, and QuickBooks online payments. And total international online revenue rose 12% YoY on a constant currency basis. 👍

Credit Karma revenues fell 12% YoY, driven by headwinds in personal loans, home loans, auto loans, and auto insurance. Where it did experience strength was in Credit Karma Money and credit cards. 🔻

Looking ahead, the company raised its full fiscal year 2023 guidance. Here’s how its YoY outlook compared to previous estimates:

- Revenue growth of 12% to 13% vs. 10% to 12%

- GAAP operating income growth of 19% to 20% vs. 9% to 13%

- Non-GAAP diluted earnings per share growth of 20%

Within those adjustments, it raised revenue guidance for the Small Business and Self-Employed group. That helped offset downward revisions for its Consumer Group, ProTax Group, and Credit Karma segment.

While executives were upbeat in their commentary, it appears investors are concerned about the underlying consumer slowdown seen in these results. $INTU shares are trading down 5% after hours.

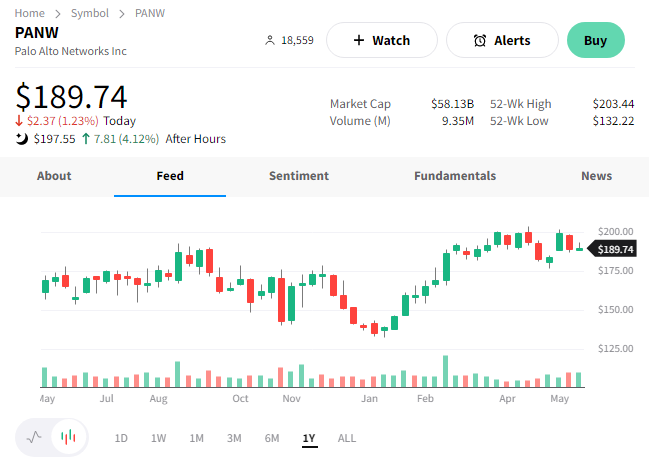

Meanwhile, Palo Alto Networks beat expectations and raised its forecast. 💪

The cybersecurity firm reported $1.72 billion in revenues and adjusted earnings per share of $1.10. Revenues matched consensus views, but earnings were $0.17 per share better. Another metric investors track, billings, rose 26% to $2.30 billion.

Executives raised their guidance. Here are their new full-year forecast vs. their previous estimates.

- Revenues of $6.88 to $6.91 billion vs. $6.85 billion

- Adjusted earnings per share of $4.25 to $4.29 vs. $3.97 to $4.03

- Billings of $9.18 to $9.23 billion vs. $9.1 to $9.2 billion

While they’re staying optimistic, they’re also not blind to the current environment. The company’s CEO said, “Our team again executed well in a market that continues to become more challenging.” As a result, the company remains focused on profitable growth, balancing efficiency goals while investing in medium-term initiatives. ⚠️

$PANW shares were up about 4% after hours, trading just below this year’s highs. 👀