Advance Auto Parts had a rough day…and that’s putting it lightly. Let’s look at what the auto parts retailer said that caused the worst one-day selloff in its history. 👇

Adjusted earnings per share of $0.72 widely missed the $2.57 expected by analysts. That’s despite revenues of $3.42 billion, only missing estimates by $0.01 billion. Not only did the significant miss cause executives to rethink their full-year guidance, but the board of directors reduced the quarterly dividend from $1.50 to $0.25 per share. ✂️

They now expect full-year adjusted earnings per share of $6.00 to $6.50, down from a previous range of $10.20 to $11.20. That comes as it reduced its sales expectations by a range of just $200 to $300 million, signaling margin troubles. For the foreseeable future, higher-than-expected costs for its professional sales, inflationary pressure, supply chain issues, and unfavorable product mix will continue to pressure results. ⚠️

Analysts believe AAP’s business model has structural issues preventing its operational teams from driving solid results. In a highly competitive space like auto parts, it’s simply not possible to skate by. And it’s clearly losing market share to O’Reilly Automotive and AutoZone, among others.

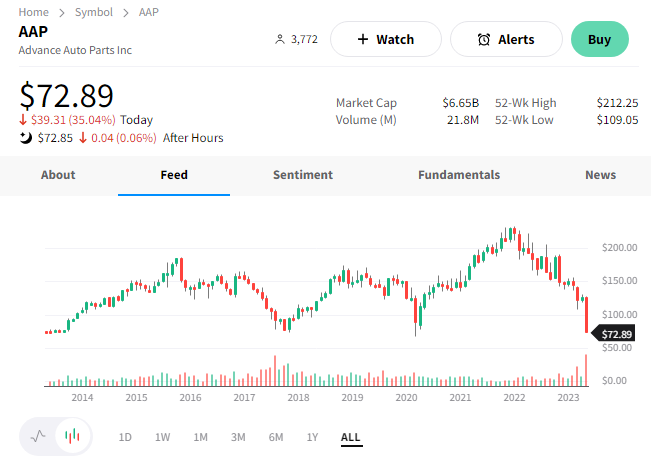

$AAP shares fell 35% and are near their 2020 and 2017 lows. 📉