It has been a tough earnings season for clothing retailers so far. However, today we heard from Lululemon, who reported that it’s been able to make lemonade out of lemons. Let’s see what it had to say. 👇

The retailer’s first-quarter adjusted earnings per share of $2.28 beat the $1.98 expected. Revenues of $2 billion also topped the expected $1.93 billion. Sales growth was 24% YoY, with China’s revenue rising 79% YoY as the country reopened its economy.

Executives pointed to China’s rebound and lower air freight as the primary drivers of the beat. Given this quarter’s strength, it was able to ratchet up its full-year revenue and earnings guidance slightly. However, its second-quarter guidance largely aligned with expectations, signaling that much of the full-year uptick simply reflected this quarter’s strength.

Although many caution signals are coming out of the consumer environment, Lululemon has two key factors working in its favor. The first is its core customer is higher income and has been able to weather inflation pressures more easily. And two, despite discretionary spending pulling back, data suggests that some consumers have shifted their view on activewear, loungewear, and footwear from a discretionary purchase to a necessity over the last few years. 👍

Investors also view Lululemon Studio, the company’s at-home fitness business, as a potential driver of future growth. It acquired Mirror for $500 million in June 2020 and has since written down most of that investment to zero. The good thing is that once you get to zero, there’s only potential upside. Well, sort of. However, executives still need to prove they can successfully shift that business away from its hardware focus and build a subscription fitness product. 🏋️♂️

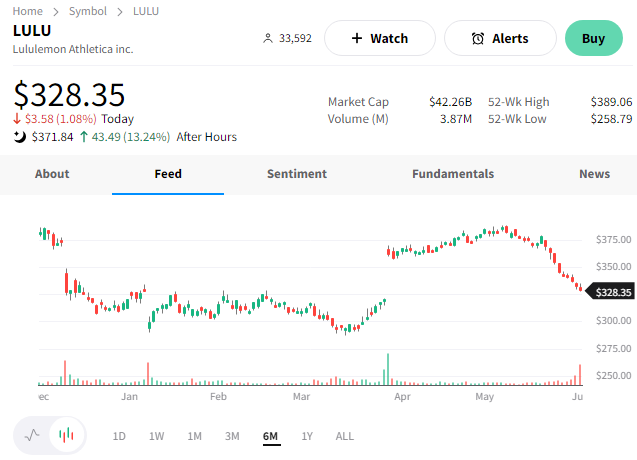

$LULU shares were down roughly 15% for the month heading into this report. The upside surprise has allowed it to recapture much of that decline after hours. 🔺

On the other end of the spectrum are retailers that haven’t yet developed a moat. For example, after reporting a first-quarter revenue miss and earnings beat, Macy’s slashed its full-year earnings and outlook. And Dollar Tree and Dollar General are sounding the alarm about the lower-income consumer. ⚠️

Overall, it remains a cautious time for shoppers across income levels. Clearly, some brands are handling this environment better than others. So far, Lululemon has been able to make lemonade out of the global economy’s lemons. We’ll have to wait and see how long that can last. 🤷