The foreign currency market doesn’t get much attention from individual investors until it’s at extremes.

Well, it’s safe to say we’re at a *relative* extreme.

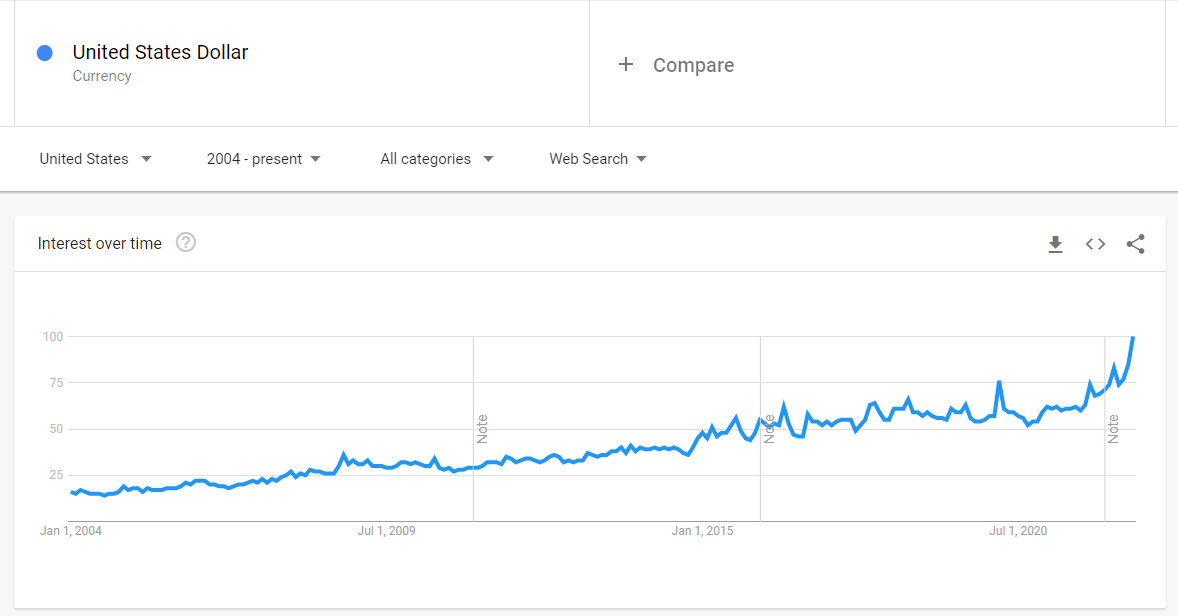

The U.S. Dollar has become a hot topic as of late, with google trends for the term “United States Dollar” hitting their highest levels ever and a google news search returning over 8.5 million results from just this year alone.

In this article, we want to break down what’s happening with the currency, what’s driving this behavior, and ultimately why investors care (or should consider caring if they don’t already).

Let’s jump into it.

When it comes to the U.S. Dollar, conversations generally fall into one of two categories:

- The purchasing power of the U.S. Dollar (how much of a good/service a dollar buys)

- The foreign exchange rate of the U.S. Dollar and other currencies (what it’s worth vs. other forms of currency)

The first one is what gets all of the headlines, and understandably so. The inflation rate in the United States (and around the world) is sitting around 40-year highs, meaning prices for everything from rent/mortgage payments to the food we eat are generally growing faster than in recent history. As a result, the same dollar buys fewer of the same goods than it did last year.

People naturally care about this more because it’s the impact we feel as we live our daily lives. Whether you’re taking a trip to the grocery store, eating out with friends, or filling up your gas tank, everyday activities have become a reminder of just how expensive things have gotten.

What caused this inflation rate is debated daily, from the halls of congress to the Twitter timelines of everyday Americans. However, a few significant factors include the Federal Reserve keeping interest rates low, the massive government spending during COVID, and the supply chain issues caused (or exacerbated by) the pandemic.

You’ll never get anyone to agree on what combination of those factors is the proximate cause (nor will they agree on a solution), which is why there isn’t much for us to add that you haven’t read elsewhere or that we’ve not written about before.

We all can agree, though, that the purchasing power of our dollar will fall over time, and it’s our job to invest in things that grow our income to keep up with rising prices.

So we’ll leave it at that and move on to category #2.

As investors, the more interesting conversation is about the U.S. Dollar’s exchange rate against other currencies because it has a host of global impacts.

First, let’s talk about what’s happening with the dollar relative to other currencies.

You may have seen a ton of headlines over the last week about the U.S. Dollar reaching parity (a 1:1 exchange rate) with the Euro for the first time since 2002. In fact, you may have read about it in the Stocktwits Daily Rip 😉

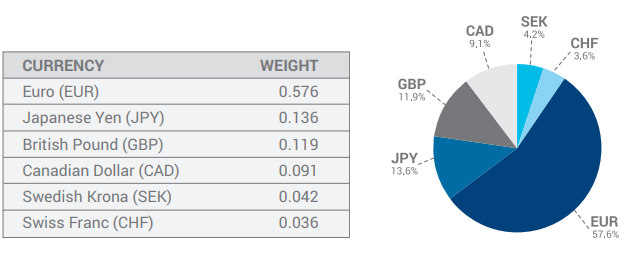

The recent decline is meaningful because the Euro is the second-most traded currency in the world and the largest holding of the U.S. Dollar Index ($DXY), which is commonly referenced on Wall Street to track the currency markets.

So as the Euro declines, the world’s foremost barometer of the dollar’s strength/weakness rises.

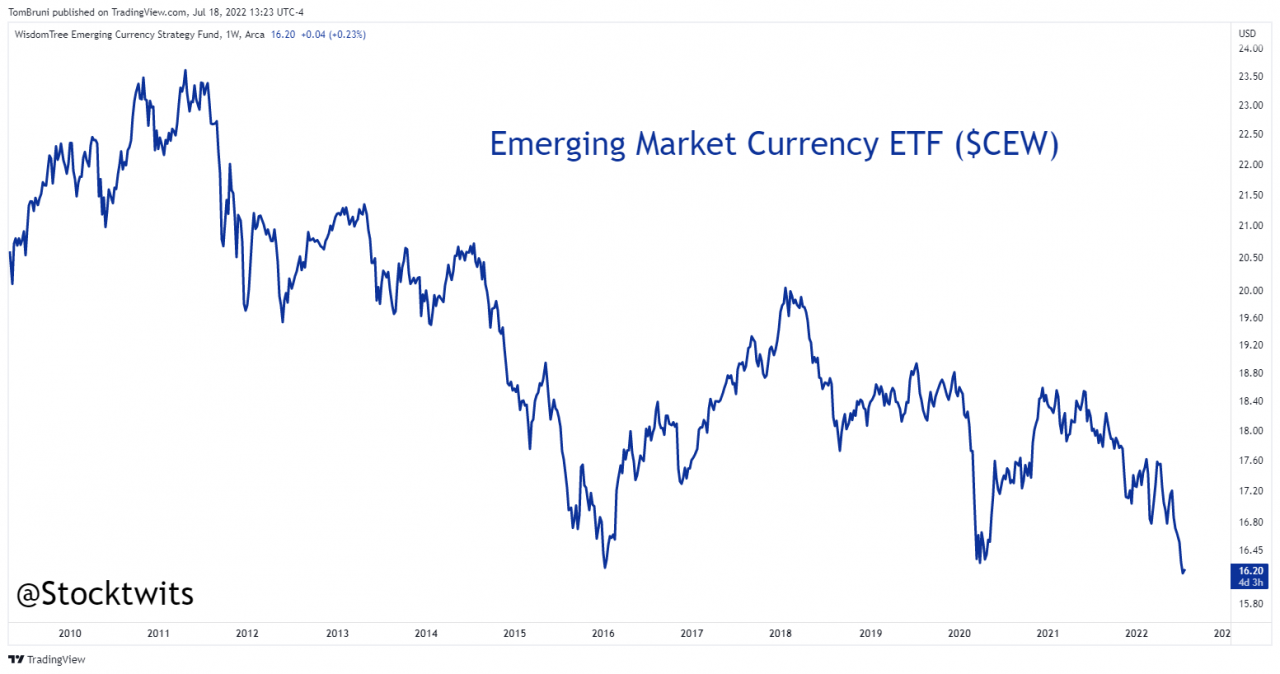

The U.S. Dollar is also flexing its strength against Emerging Market currencies. An easy way to measure this is by looking at the WisdomTree ETF $CEW, a basket of 14 Emerging Market currencies, which just set a new all-time weekly closing low.

So, the “what” is that the U.S. Dollar is currently at multi-decade highs relative to most developed and emerging market currencies around the world.

Next, let’s talk about what’s causing this strength.

The first is that the U.S. has a history of paying back its debts. After separating from the gold standard in 1971, the U.S. Dollar has since been backed by the “full faith and credit” of the U.S. government. And that’s not something the government wants to renege on anytime soon.

Time and time again, the U.S. government has shown us that they make good on their debts, even if that means raising the deficit and borrowing more money to do so.

There’s a reason the U.S. Dollar is the global reserve currency, with about 60% of all central bank foreign currency reserves. Creditors will get their money back, though it’ll probably have less purchasing power than when they lent it.

The second reason is that the U.S. economy is often viewed as the “best house in a bad neighborhood.” When times are good, the U.S. economy and financial markets tend to lead the charge, while during downturns, it often holds up better than other areas of the world.

Currently, the market is pricing in a potential global recession as central banks fight inflation by aggressively raising rates and taking other policy measures.

In the U.S., inflation is high, but several measures have suggested the core numbers that exclude energy and food prices have begun to come down. That, plus a strong labor market, leads many to believe that a recession in the U.S. will be short and shallow.

Meanwhile, the European Union is dealing with a food and energy crisis due to the Russia/Ukraine war and their reliance on Russia for their energy needs. Unfortunately, there are no easy solutions to that problem, meaning inflation will likely remain high and economic growth will likely slow (or contract) in the region.

The third reason is that the global oil market runs on U.S. Dollars. The fact that oil trades in dollars has hurt many emerging markets, like India and the Philippines, which import the majority of the oil/energy needs. As a result, they’ve seen a significant depreciation in the value of their currencies. Additionally, these countries’ economic growth suffers because a key driver of their economy (energy) just became significantly more expensive, further weakening demand for their currency.

The last reason is that real interest rates in the U.S. are often higher than in other areas of the world. The Federal Reserve has taken swifter action in raising rates than Europe and other developed regions, and inflation is also lower. As a result, U.S. Treasury Bonds have become an attractive alternative. And in order to buy U.S. Treasuries, you need…U.S. Dollars.

So as you can see, all these reasons working in tandem have created significant demand for U.S. Dollars, hence its rapid appreciation over the last year.

Lastly, let’s talk about why this rapid appreciation in the U.S. dollar matters to investors.

First off, many people hold international stocks as part of their asset allocation. For example, most 401k and retirement account allocations have a sliver of international stock and bond exposure. If you hold global stocks, there are two primary drivers of their performance, the stock’s performance (typically the primary driver) and the currency performance (typically the secondary driver).

Let’s say you own $EWG because you want exposure to German stocks. The exchange-traded fund (ETF) owns those stocks in their local currency (the Euro), but since you live/invest in the U.S., you’ll be using dollars to buy and sell them.

So let’s say you invest in the ETF, and the underlying stocks appreciate by 5%, but the Euro depreciates by 5%. Well, your net return when you sell will be roughly 0%.

Whether you realize it or not, when you own international stocks, you’re making a bet on that stock and the currency it’s held in. And generally speaking, when the dollar rises, it’s a headwind for U.S. investors/traders that own international stocks. And when the dollar falls, it’s a tailwind.

Secondly, the U.S. Dollar affects the overall macro economy and U.S. company earnings.

Multinational companies will likely see significant impacts on their earnings due to the dollar’s appreciation. Not only will a weaker currency abroad reduce demand for U.S. goods, but the profits they do make will have to be converted back from the local currency into dollars when they report earnings, often creating currency-related “accounting losses.” Microsoft warned of this impact in early June, and ServiceNow reiterated the issue just a week ago while speaking on CNBC’s Mad Money. As a result, adverse currency impacts will likely be a significant theme as we head into earnings season.

Lastly, the strength/weakness of the U.S. Dollar affect the supply/demand for other asset classes. This one is the hardest to discuss with any certainty because historical correlations and Intermarket relationships are constantly changing, which is why we won’t spend much time on it.

An easy example may be if the U.S. Dollar is in a period of prolonged strength, gold/silver and other precious metals probably aren’t performing that well — and vice versa. Again, these relationships change regularly, so it’s tough to assign them too much weight in your decision-making, but they’re good to be aware of.

So to summarize this section, the U.S. Dollar matters to individual investors because it can impact their international stock holdings and the earnings of the U.S. companies they own.

Okay, we realize that was a lot to chew on, so we’ll send you off with a TLDR version of the entire article:

- The U.S. Dollar has been appreciating over the last year and is now at multi-decade highs relative to most developed/emerging market currencies

- This appreciation has been driven by the U.S.’s global reserve currency status, higher real interest rates, fears of a global recession, and a global energy market that’s in crisis

- The strength of the U.S. Dollar matters to individual investors because it affects the returns of the international stocks they own, as well as the earnings of the U.S. companies they own

Expect more on this topic in the future, as it’s likely to remain a key factor in the markets for the foreseeable future.