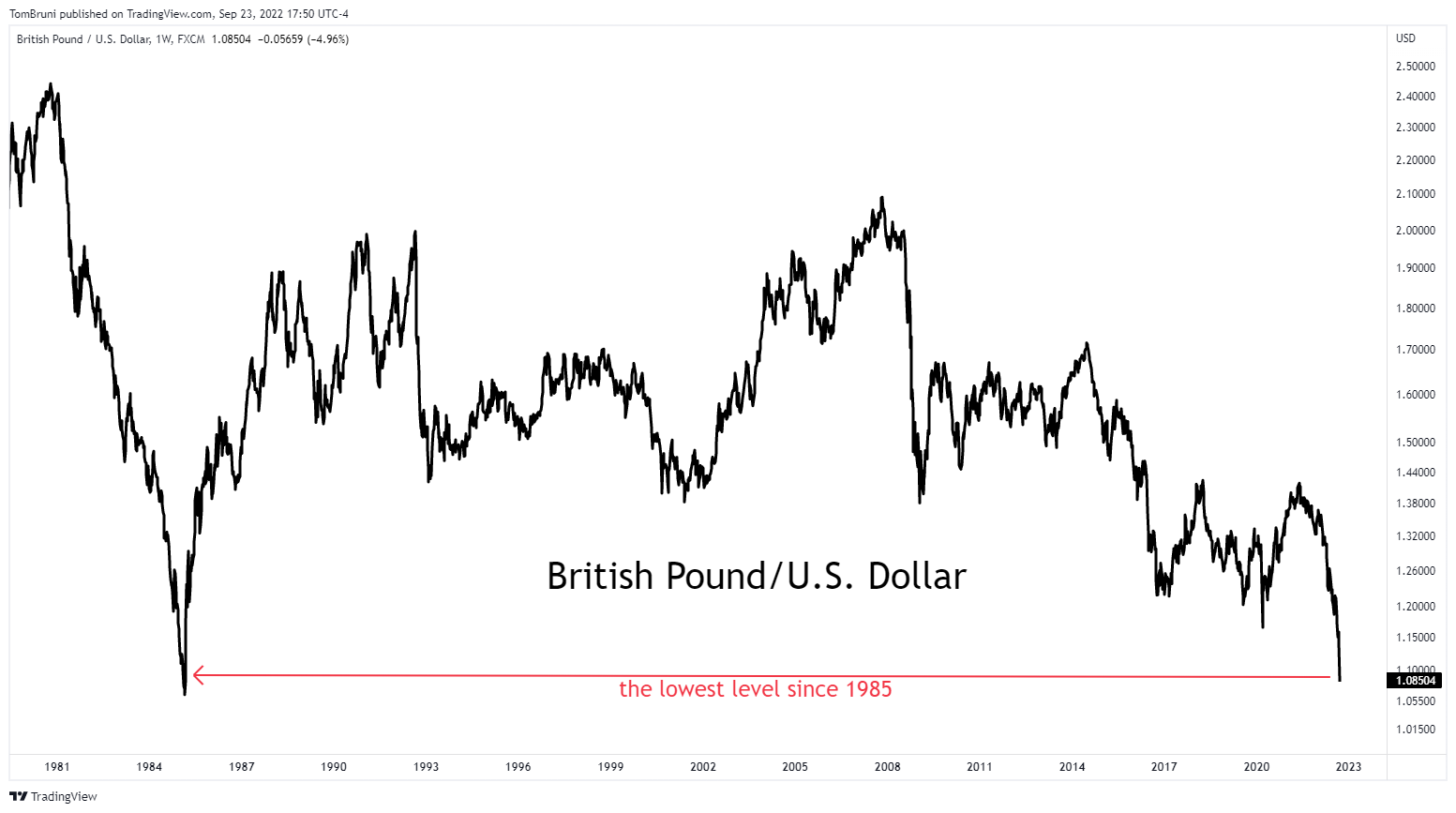

The U.K. economy is struggling as Europe deals with an energy and economic crisis. As a result, its currency has fallen heavily against the U.S. Dollar like its peers, the Euro, Yen, and others. 📉

Yet despite record-high inflation and a crashing currency, today, the government outlined plans to cut taxes and boost spending to stimulate its economy. The news sent the GBP/USD pair to levels not seen since 1985 and U.K. government bond yields soaring.

The policy decisions are a clear case of the country’s fiscal and monetary efforts being at odds. The Bank of England is raising interest rates to slow the economy and contain inflation. And now, the government is making efforts to increase economic growth. 🤦

Meanwhile, the tools both sides are using affect demand and don’t solve the supply-side issues that are pushing prices up throughout the country.

Market participants say these actions have caused U.K. officials to lose whatever credibility they had left in the financial markets. And given the overall mess its economy and energy markets are in, many expect the country to be in for a very cold winter… 🥶