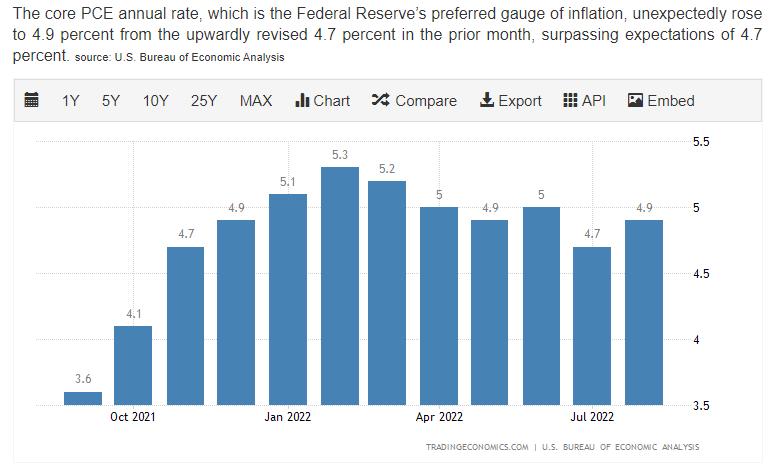

The Federal Reserve’s preferred inflation metric is the core Personal Consumption Expenditures (CPE) price index. Today’s data showed that this measure rose 0.60% MoM in August, bringing its YoY reading to 4.90%. 🔺

This data has been volatile over the summer but had made downward progress since March, that is until now. 😮💨

The Fed prefers this measure as the broadest indicator of where prices are heading as it adjusts for consumer behavior. So far this year, readings have remained elevated well above the central bank’s long-run target of 2%.

Despite Powell waging a war on inflation, many inflation pressures remain. Personal income rose 0.3% in August, and spending rose 0.4%, showing that consumers continue to spend (though they’re getting less for their money). Housing has slowed, but prices haven’t come down meaningfully. And the job market remains hot hot hot. 🔥

Over the last few weeks, the market has begun to accept the fact that the Fed will continue tightening aggressively. The progress it’s seen in bringing down prices has not been great. While we may have seen peak inflation, what we haven’t seen is meaningful progress back towards 2%.

That is what’s keeping the Fed in tightening mode and the market in freakout mode. 😱

There were some other economic data points today, but none that really moved the needle. You can check them out here: Chicago PMI, Quarterly Grain Stocks, and Michigan Consumer Sentiment.