Energy stocks continue to pump out profits, fueling the industry’s biggest names to all-time highs. ⛽

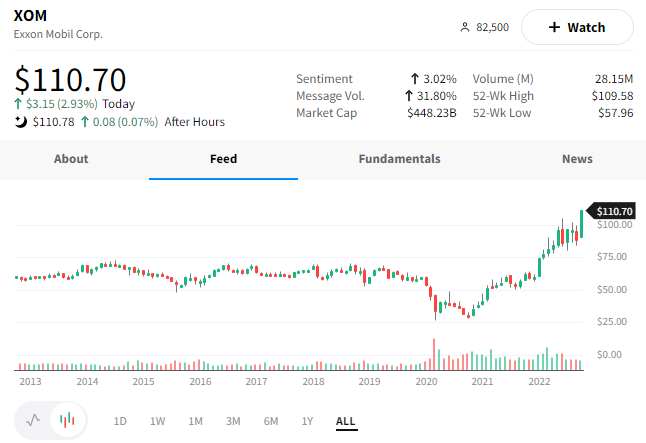

Exxon Mobil blew away expectations, recording a $19.7 billion profit in the third quarter. For context, that’s almost as much as Apple’s $20.7 billion profit quarterly profit!

On an earnings-per-share basis, its $4.68 profit beat the $3.89 consensus estimate. Meanwhile, revenues jumped 52% YoY to $112.1 billion. 🤩

Its oil-equivalent production was up 50,000 barrels per day to 3.7 million. Higher production volumes and higher selling prices across its products helped drive the massive sales increase.

The company reiterated that its investments throughout the slowdown of the last few years left it well-positioned to take advantage of the current boom. As a result, it has plenty of cash to return to shareholders. It will maintain its $30 billion share buyback through 2023 while also increasing dividends.

The quarterly results helped push $XOM shares to fresh all-time highs in what’s one of their strongest months in decades. 💪

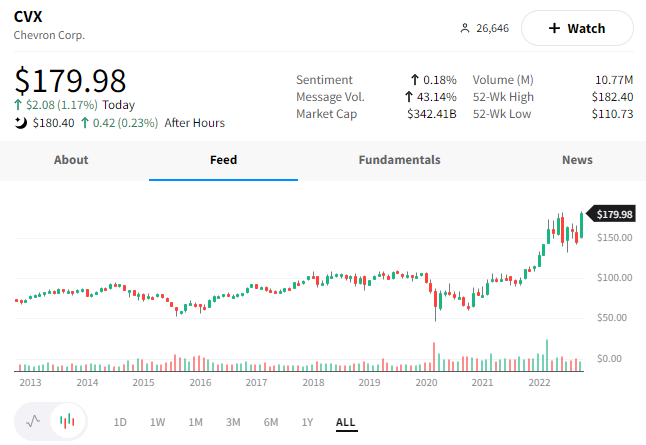

Chevron also beat expectations handily, reporting its second-highest quarterly profit ever. 📝

Profits of $11.2 billion, or $5.78 per share, rose 84% YoY and beat Wall Street’s estimates of $4.86 per share. Within that, its oil and gas business operating profit rose 81% to $9.3 billion. And operating profit in its oil refining business nearly doubled to $2.5 billion.

Like Exxon, rising U.S. production volumes and higher product prices helped drive the record quarter. Meanwhile, its return on capital employed, which investors use to measure what it earns from each dollar invested in the business, rose to 25%.

Finally, refined product sales were up 5% YoY, driven by its acquisition of Renewable Energy Group. Due to planned maintenance, Chevron’s core refineries processed about 13% fewer barrels per day.

The strong results helped push $CVX to fresh all-time highs in today’s session. 📈

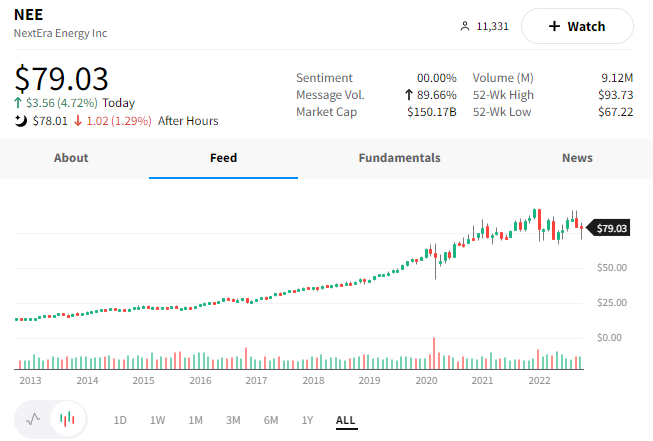

While not an oil and gas giant, it’s worth mentioning NextEra Energy since it’s the U.S.’s largest electric utility holding company. ⚡

The company’s $6.72 billion in revenue was roughly $1 billion above estimates, while earnings per share of $0.85 beat the $0.80 expected.

Global demand for alternative energy sources and surging power prices helped drive the beat. Executives expect the strong results to continue, saying the company is well-positioned to take advantage of the U.S. Inflation Reduction Act, which should fuel demand for green energy and reduced carbon emissions. 📈

They also provided an update on the large portfolio of operating landfill gas to electric facilities it’s buying for about $1.1 billion. It expects the transaction to close early next

Shares of $NEE were up nearly 5% today but remain in the middle of a multi-year range. 🤷