Crude oil remains under pressure as China’s lockdowns weigh on demand and fears of a global recession rise.

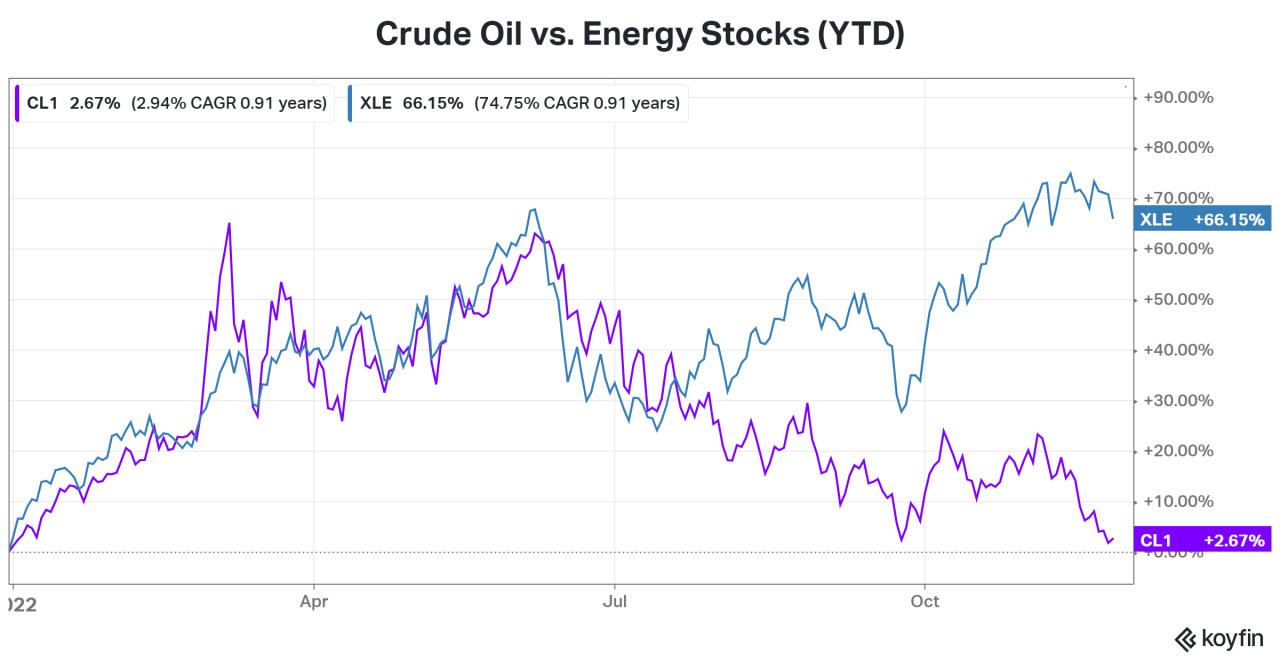

With that said, one thing that traders are keeping an eye on into year-end is the divergence between crude oil’s price and energy stock performance. The two had traded in tandem from January through July when they began to go their separate ways. 🧭

While energy remains the best-performing sector year-to-date, many traders are wondering whether or not it will “catch down” to the price of crude over the coming months.

Bulls argue that the structural energy issues and record profits justify the strength of energy stocks. However, bears say that this divergence cannot last. And with global demand for oil and other energy products falling, then energy stocks will have to fall. 🐂 🐻

Who will be right remains to be seen, but this is a major theme the community is watching. 👀