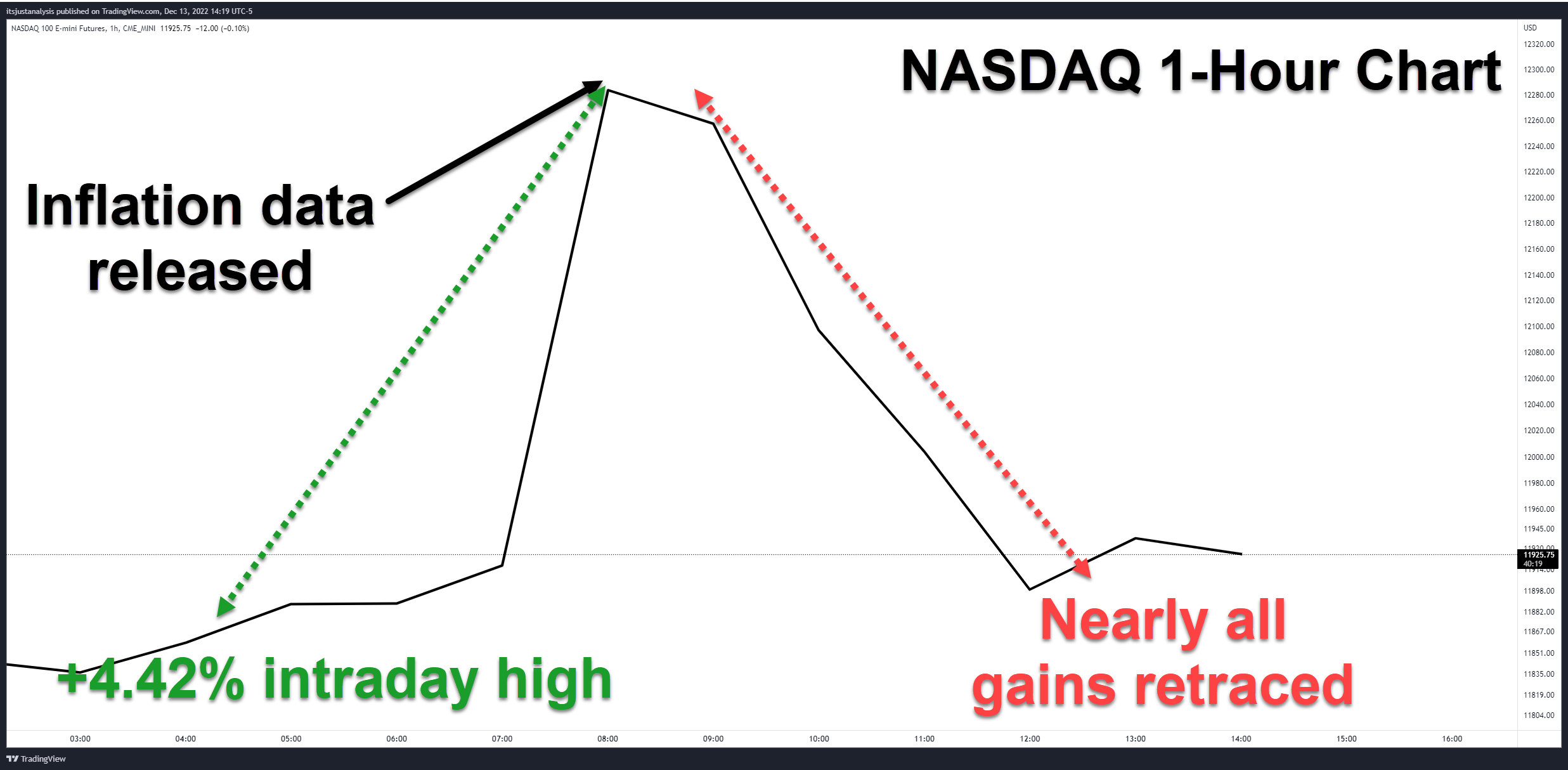

Yesterday’s Daily Rip highlighted an increased chance for whipsaws this week. And boy oh boy, did we get some whipsaws today.

After inflation data hit, the indices made some big drives higher and then retraced nearly all of those gains.

The inflation numbers were better than expected and better than their prior reading – but with tomorrow’s interest rate decision and Powell’s presser looming over the market, analysts expect less gambling and more risk aversion. ♦️

Today’s inflation numbers:

- Inflation Rate MoM +0.1% vs. +0.3%, prior +0.4%

- Core Inflation Rate MoM +0.2% vs. +0.3%, prior +0.3%

- Core Inflation Rate YoY +6% vs. +6.1%, prior +6.3%

- Inflation Rate YoY: +7.1% vs. +7.4%, prior +7.7%

- CPI 297.711 vs. 298.045, prior 298.012

- IBD/TIPP Economic Optimism 42.9 vs. 41.3, prior 40.4