U.S. new home sales rose 4.1% MoM to an annual rate of 683,000 in April, topping the 669,000 expected by analysts. However, March’s initial 9.6% increase was revised downward significantly to 656,000. 🏘️

The theme investors are watching is that the ongoing lack of existing homes for sale is forcing buyers into new construction. We’ve heard this from builders, who remain cautiously optimistic despite high-interest rates and prices weighing on affordability.

Speaking of prices, there is some positive news for hopeful buyers and the Federal Reserve. 👍

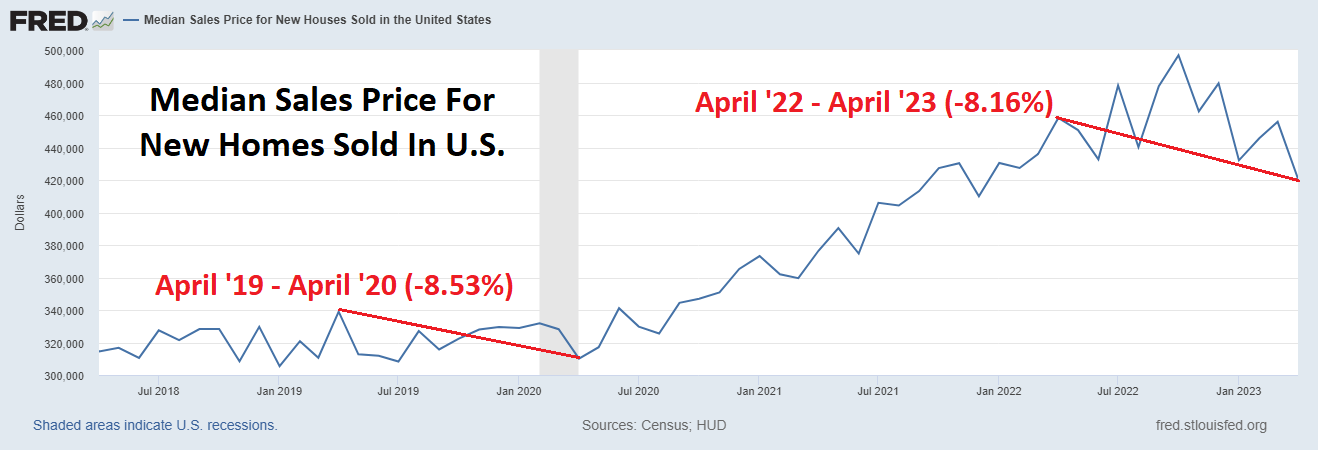

April’s data showed that the median sale price of new homes in the U.S. experienced a YoY decline for the first time since April 2020. New data showed that prices declined 8.16%, nearly matching the last time this data saw an annual decline. It’s currently sitting at $420,800, down from October’s $496,800 peak. 🔻

However, the long-term trend in this housing data shows prices are still above trend. Below we’re looking at the same data over the last thirty years. Clearly, the pandemic housing boom caused prices to rise at a much steeper pace than at other periods in history. 😬

That rise in asset prices and housing spending was a key driver of inflation, so the Fed hopes this data will continue to revert to its historical average. Because if it does, that’ll make the central bank’s fight against inflation a whole lot easier.

So far, Home Depot and other retailers have offered cautious consumer outlooks, expecting the housing market cooldown to continue. We’ll have to see if they’re right, but today’s data further enforces that view. 📝